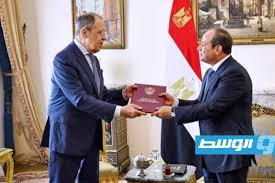

Egypt Today published an article on the outcomes of a meeting between Egyptian President Abdel Fattah el-Sisi, senior members of the Egyptian government, and Russian Foreign Minister Sergey Lavrov. During the meeting, the Egyptian side confirmed its support for Moscow’s implementation of projects related to the Russian industrial zone in the Suez Canal Economic Zone and the El Dabaa nuclear power plant.

The “Russian industrial zone” project—under which Egypt has allocated land to Russia in the Suez Canal area—envisions long-term preferential conditions and the potential transformation of this territory into a hub for Russian companies engaged in manufacturing and exporting goods.

The development of the El Dabaa nuclear power plant under the auspices of Rosatom strengthens the Kremlin’s position in the energy sector of the Mediterranean and North Africa. Large volumes of electricity generation and associated technologies create long-term economic ties, while also potentially enhancing Egypt’s energy independence. At the same time, the project establishes technological and security linkages with Russia’s nuclear sector, displacing American technological solutions.

Both initiatives deepen economic and technical integration between the two countries and create a long-term platform for advancing Russian interests in the region. Lavrov reaffirmed the Kremlin’s intention to expand bilateral relations and reinforce the strategic nature of the partnership with Egypt, placing particular emphasis on agreements reached between Vladimir Putin and Abdel Fattah el-Sisi.

This cooperation reflects Russia’s growing influence in the Middle East and North Africa, which comes at the expense of Egypt’s cooperation with the United States—its traditional partner in security, military-technical cooperation, and diplomacy. Moreover, the expansion of Russia’s presence in the Suez Canal zone may have geopolitical implications for U.S. interests in trade and maritime security, given that this waterway is a critical artery for global supply chains. For the White House, these developments signal a weakening of U.S. positions in a region where Washington seeks to maintain dominance in security, energy, and economic cooperation.

Africa and the Middle East remain strategically important regions for the United States. Washington seeks to preserve its influence through diplomatic, military, and economic instruments, working with key regional partners. Egypt is one of the White House’s principal partners in the Suez Canal region, North Africa, and the Middle East. The expansion of Russian-Egyptian projects—including industrial zones and energy facilities—poses a potential challenge to U.S. influence. Russia’s growing economic and technological footprint in Egypt also aligns with Moscow’s broader “multipolarity” strategy, which often runs counter to Washington’s political and economic objectives.

In addition, Egypt’s strategic role in peace initiatives related to conflicts in Gaza, Sudan, and Libya makes it a critical partner for the United States in addressing these protracted crises. These shifts are occurring amid an ongoing struggle among the United States, Russia, and China for influence in North Africa, where large-scale economic and infrastructure investments have become instruments of geopolitical competition.

The deepening of economic, energy, and political cooperation between Moscow and Cairo—particularly through the establishment of a Russian industrial zone and the construction of the El Dabaa nuclear power plant under Rosatom—creates long-term ties that strengthen Russia’s strategic influence over Egypt and reduce Cairo’s dependence on Western partners. As a result, traditional U.S. influence is weakened, while Moscow’s ability to shape political decisions on key regional issues increases.

- The placement of Russian industrial and logistics infrastructure near the Suez Canal provides the Kremlin with economic and operational footholds along one of the world’s most important trade corridors, potentially limiting the United States’ ability to maintain a dominant role in regional security and freedom of navigation.

- Energy cooperation between Russia and Egypt, centered on the El Dabaa nuclear project, increases Cairo’s technological and financial dependence on Russian solutions. This dependence narrows U.S. opportunities to promote its own energy standards and alternative projects in North Africa and the Mediterranean.

- Russia’s investments in long-term economic projects in Egypt—creating jobs and supporting industrial development—strengthen its image as a reliable partner, potentially reducing the appeal of Western economic and security initiatives for regional elites.

- The expansion of Russian influence in Egypt may lead to closer coordination between Moscow and Cairo on conflicts in Gaza, Sudan, and Libya. Russian leverage could alter the balance of peace processes in the region, complicating coordination with the United States and its allies.

U.S. Response Scenarios to Russia’s Expanding Footprint in Egypt

Russia’s growing industrial, energy, and political presence in Egypt creates a strategic dilemma for the United States. Washington faces a choice between accommodation, selective pushback, or active containment. Each option carries distinct risks, costs, and second-order effects.

Scenario 1: Strategic Accommodation (Low-Confrontation Approach)

Description

The United States tacitly accepts a limited expansion of Russian economic and energy projects in Egypt while prioritizing stability, access to the Suez Canal, and cooperation on regional security issues (Gaza, Red Sea shipping, counterterrorism).

Key U.S. actions

Avoid direct pressure on Cairo over the Russian industrial zone and El Dabaa NPP; Maintain military aid and security cooperation to preserve baseline influence; Focus diplomacy on crisis management rather than influence competition

Rationale

- Prevents Egypt from accelerating a geopolitical pivot away from Washingto; Preserves operational cooperation with Egyptian security forces; Avoids pushing Cairo closer to Moscow or Beijing

Risks

- Normalizes Russian strategic entrenchment near the Suez Canal; Signals declining U.S. resolve to regional partners; Allows long-term erosion of U.S. leverage in energy and infrastructure standards

Likely outcome

- Short-term stability, long-term strategic loss; Russia consolidates influence gradually with limited resistance

Scenario 2: Competitive Re-Engagement (Selective Pushback)

Description

Washington responds by reinvesting politically, economically, and technologically in Egypt to compete with Russian offerings—without forcing Cairo into an explicit “either/or” choice.

Key U.S. actions

- Expand U.S. and allied investment packages (energy, ports, digital infrastructure); Offer alternative energy solutions (gas, renewables, grid modernization, SMRs); Tie future military aid and technology transfers to transparency and diversification; Deepen U.S.–EU coordination on Egypt engagement

Rationale

- Preserves Egypt’s strategic autonomy while limiting Russian dominance; Competes on attractiveness rather than coercion; Aligns with Egypt’s desire for multipolar partnerships

Risks

- Higher financial and political costs for Washington; Partial success only—Russia retains some footholds; Requires sustained U.S. attention amid global commitments

Likely outcome

- Balanced influence environment; Egypt hedges between major powers rather than aligning fully with Russia

This is the most realistic and sustainable option for Washington.

Scenario 3: Containment and Pressure (Hardline Approach)

Description

The U.S. treats Russian projects in Egypt as a direct strategic threat and seeks to limit or disrupt them through sanctions, conditionality, and diplomatic pressure.

Key U.S. actions

- Threaten or apply secondary sanctions linked to Russian industrial and nuclear projects; Restrict technology transfers to Egyptian entities cooperating with Russia; Use leverage in international financial institutions

- Increase scrutiny of Rosatom-linked financing and security risks.

Rationale

- Sends a strong deterrent signal; Raises costs for deep Egypt–Russia integration; Demonstrates U.S. red lines on strategic infrastructure.

Risks

- High probability of backlash from Cairo; Accelerates Egypt’s pivot toward Russia and China; Undermines U.S. credibility as a reliable partner.

Likely outcome

- Strategic rupture risk; Reduced U.S. access and influence in Egypt and the Suez region.

Scenario 4: Multilateral Constraint (EU–G7 Alignment)

Description

The U.S. embeds Egypt policy within a broader EU–G7 framework aimed at limiting Russian strategic influence without isolating Cairo.

Key U.S. actions

- Coordinate with EU on export controls, nuclear governance, and infrastructure norms; Promote joint U.S.–EU investment alternatives; Use regulatory, safety, and compliance standards to constrain Russian projects; Frame engagement around regional stability and maritime security.

Rationale

- Dilutes perception of unilateral U.S. pressure; Raises compliance costs for Russian projects; Preserves Egypt’s diplomatic room for maneuver

Risks

- Slower decision-making; Requires high transatlantic cohesion; Russia exploits coordination gaps.

Likely outcome

- Gradual containment of Russian influence; Stronger Western position without direct confrontation.

Comparative Risk–Reward Snapshot

| Scenario | U.S. Leverage | Risk of Egypt Pivot | Cost to U.S. | Long-Term Effect |

| Accommodation | Low | Medium | Low | Russian dominance |

| Competitive Re-Engagement | Medium–High | Low | Medium | Balanced influence |

| Containment | Low | High | Medium–High | Strategic rupture |

| Multilateral Constraint | Medium | Low–Medium | Medium | Controlled competition |

For the United States, Egypt remains too strategically important to lose—but too autonomous to coerce. The most effective response lies in competitive re-engagement combined with multilateral constraint, rather than sanctions-driven pressure.

Failure to act risks allowing Russia to transform economic projects into long-term strategic leverage at the heart of one of the world’s most critical trade corridors.