In the early century, China trumpeted a large economic expansion into Latin America. The region, however, did not neocolonize under the African scenario. China keeps on investing and expanding its influence, though a bulk of crucial projects have not yet been carried out. This largely comes from the traditional ties of the Latin American countries with the United States and the EU.

China’s interest in Latin America, as in other parts of the world, is to gain a market and access to raw materials. China is steadily increasing trade turnover, expanding its geography and trade volumes, building infrastructure for its raw material needs, gaining access to raw materials under the “raw materials in exchange for aid” scheme, and making cultural and educational expansion through Confucius institutions, going forward.

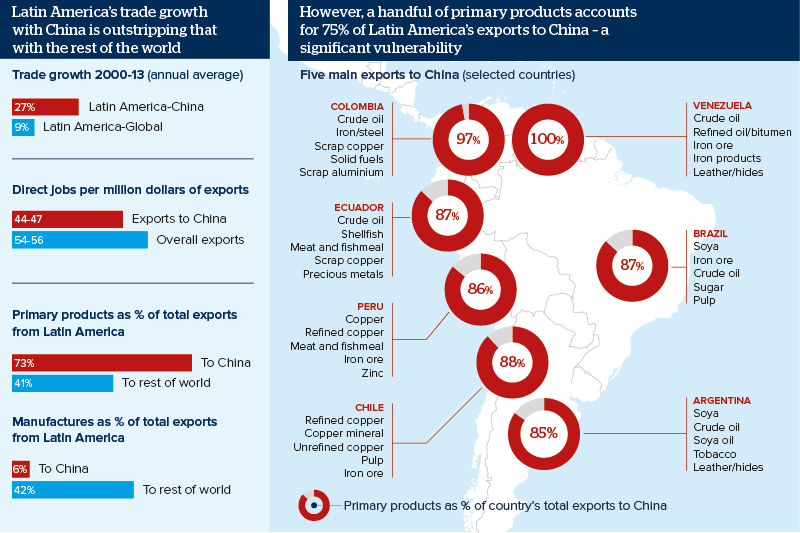

Raw materials – mineral and agricultural – are Beijing’s major interest in Latin America. Oil, iron, copper, and soybeans are the main products the PRC purchases in the region. China is acting pointwise – becoming active in those areas and in those countries that are of vital importance to it, trying not to show total activity.

There are three main countries China is interested in in terms of access to mineral resources: Venezuela, Chile, and Peru. Caracas is important to Beijing for oil supplies. Venezuela’s oil fields, de facto, have come under control of Russia and China, Venezuelan experts close to the opposition claim. At least 65% of Venezuelan oil went to China in the first quarter of 2020. The share of Venezuelan “black gold” supplies to China is generally small – nearly 3%, the country being a top ten supplier, however.

Caracas received $ 62 billion in loans from Chinese banks for the entire investment period. 21 billion investments in 790 joint projects should be added to that, targeting the car assembly, electronics, infrastructure development, and, primarily, oil output and refining. Moreover, Venezuela has imported significant number of Chinese weapons. Beijing is now looking for opportunities to hold its ground and obtain economic benefits amid unrest in Caracas.

Chinese companies are trying to gain a foothold in the energy production market throughout the region, where possible. They work in Brazil as well, entering the growing market for pre-salt oil output. China’s CNPC dominates in oil output in Peru, and China’s CNOOC owns 50% of Bridas Corporation, Argentine oil and gas company. Moreover, China controls oil exports from Ecuador by providing funds for infrastructure projects. Mexico and Colombia – large mining countries with close ties to the Western world – are outside China’s zone of influence.

China is also wax enthusiastic about metal supply from South America. Chile is a traditional copper supplier to the Chinese market, 96% of all exports to the PRC accounting for it. Beyond that, China’s Tianqi Lithium has access to Chilean lithium deposits. Beijing has gained control over Bolivian deposits of this element as well. Peru is dependent on copper and gold exports to China. Brazil is a major supplier of iron ore to China. At the same time, co-projects are located not only in South America, but in China as well.

Food supply to China is the second key resource for Latin America; Brazil and Argentina being the two major partners. The Chinese industry is dependent on soy imports. The main supplies account for Brazil (about 60%). Given the United States is a key player in the market, this trade is of strategic geo-economic importance. Brazil, in addition, is the top beef supplier to the Chinese market. To meet growing exports, China is investing in infrastructure, modernizing port facilities in this country. China is the largest investor in the Brazilian economy, mainly concentrating the investments in the states of São Paulo, Rio de Janeiro, and Minas Gerais, including in heavy industry.

Argentina is another China’s key partner in food supply in the region. The PRC is a key point for Argentine beef supply. Barley, soybeans (Argentina is the third largest producer in the world), soybean meal and soybean oil supplies are increasing as well.

Paraguay is also China’s significant food supply partner in the region. Dialogo Chino experts, all in all, estimate China’s total cumulative investment in soybean production in South America at $ 40 billion, and in beef production (including Bolivia) – at more than $ 10 billion.

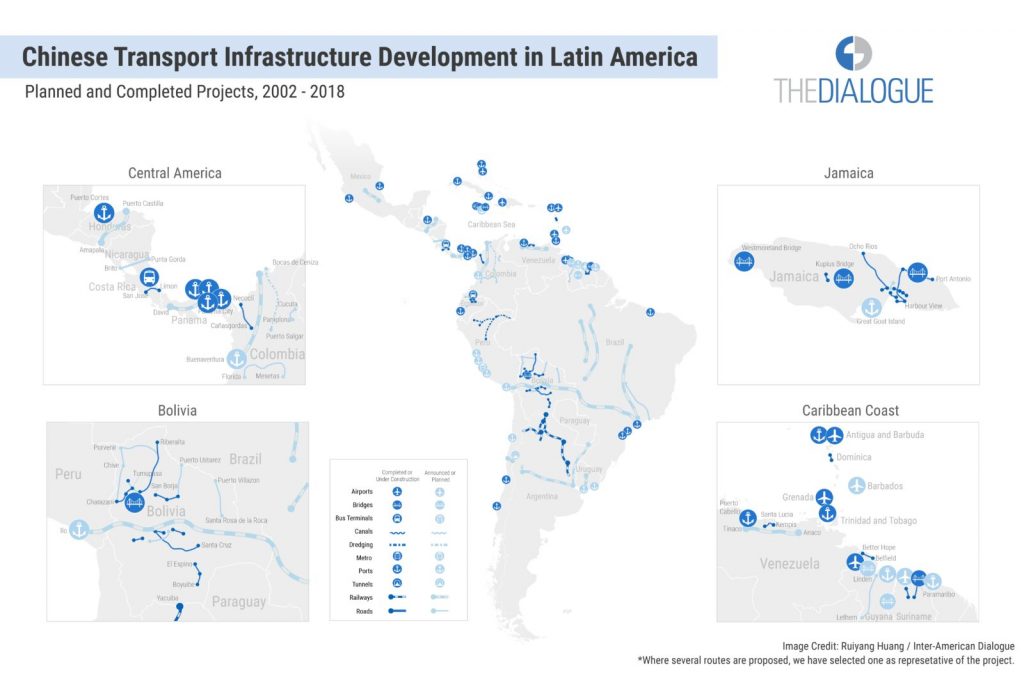

In the early 20th century, China wanted to carry out several large-scale transport and infrastructure projects in the region that could change the economic situation in favor of strengthening China’s hand.

The first project was the Nicaraguan Canal development, supposed to become an alternative to the Panama Canal and connect the Atlantic and Pacific Oceans.

The second one was a transcontinental high-speed railway from the Atlantic to the Pacific Ocean. It was to become the largest Chinese infrastructure facility in South America and run from Puerto Santo in Brazil to the Peruvian port of Ilo. It was tentatively estimated at US $ 10 billion. Both the first and second projects would have doubled down Latin America’s economic integration and facilitated further Chinese economic expansion into the region.

Both projects, however, were hardly implemented. We believe this is over the US and the EU – the traditional players in the region – reaction to them. Although the West cannot provide the financial backing comparable to the Chinese expansion, the political influence of these geopolitical actors is still at high level in the region.

For that very reason China’s military and technical cooperation with Latin America’s countries can hardly satisfy Beijing so far. Venezuela is the main permanent consumer for Chinese weapons in the region, purchasing Chinese infantry fighting vehicles, Y-8 transport aircraft, self-propelled mortars, multiple launch rocket systems, and various guided missiles. Military cooperation with Cuba – another historical China’s ally in the region – is taking place as well at the level of inter-army exchanges. Explosives also used to be supplied there. A radar was discovered near the Cuban city of Bejucal (Mayabeque province, 20 km south of Havana, the former Russian Lourdes SIGINT facility) in 2018. Experts linked it to China’s interests.

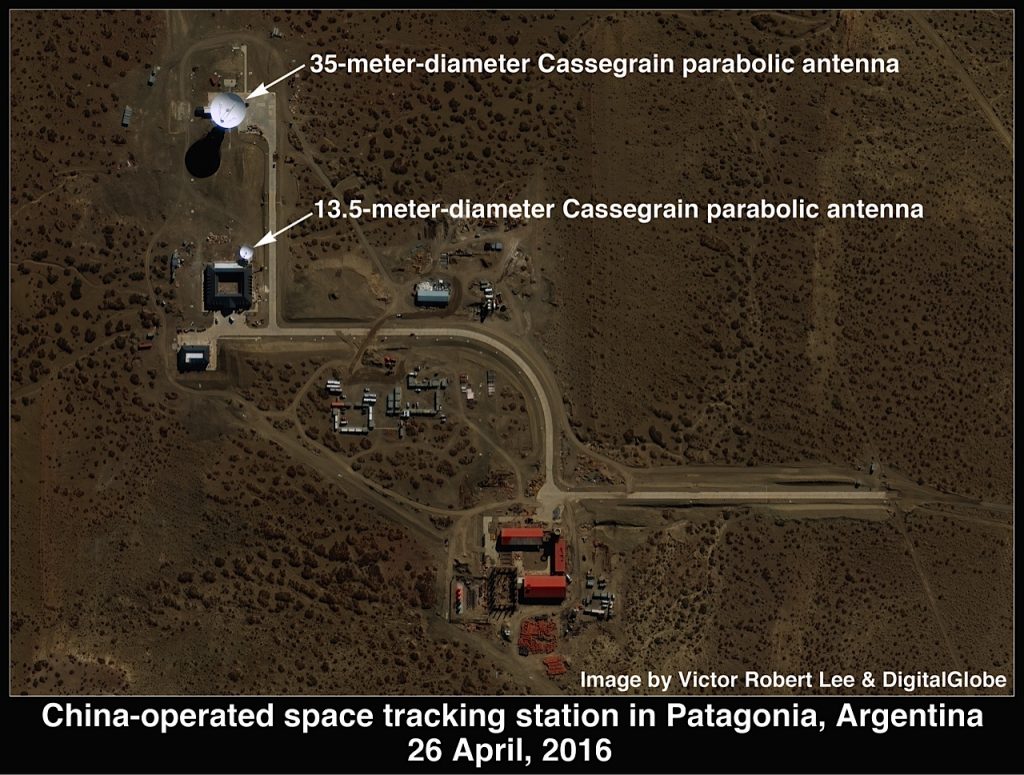

Argentina received a loan for the construction of hydroelectric power plants in the amount of $ 11 billion in 2014. Just immediately after this decision, the Argentine Congress voted for the construction of a Chinese satellite tracking facility in Neuquen, one of the country’s southern provinces. The facility was part of the project for the far side of the moon development, the outer space observation, and the Chinese orbital satellites constellation control. Such isolated facility can be of dual use.

Despite all this tactical success and attempts to use friendly political regimes for its own benefit, China has failed to establish economic hegemony in the region, as it actually did in Africa. Main reasons are:

democracy progress, social and economic development, prosperity, and education level in Latin America is still much higher than in the sub-Saharan region. This changes the national governments’ line, which are, nevertheless, more or less dependent on democratic procedures. Beyond that, the US and the EU’s interests are much more strongly represented in the region. And, though Western states cannot compete with the PRC in investment and financial backing, geopolitical and cultural ties do their part.

We believe China will go ahead with economic expansion into the countries of the region in the years ahead and will make attempts to gain control over the natural resources it is interested in. Expansion in the next decade, however, will not be as global as in Africa. Top geo-economic projects that might have a major impact on the regional balance will be hampered by changing local elites. Latin America, consequently, might become the first region where China will not succeed in achieving its geopolitical ambitions in full. This will not affect the level of countries’ involvement in trade with the PRC, however.