Russia is trying to exert pressure on the EU to make the Ukraine government sign a short-term gas transit deal and abandon financial claims to Gazprom, the company which could face bankruptcy if all debt payments are enforced under various arbitrations.

Gazprom has found itself in an obviously losing position, which pushes its leadership to voice manipulative statements and go for an actual blackmail. Officials in Moscow realize they can’t halt Ukraine transit at least for another year. To complete the pipe-laying process alone, at least 45 days are required given favorable weather conditions. The analysis of meteo data by Floris Goerlandt of Dalhousie University, Osiris A. Valdez Banda of Aalto University, and Jakub Montewka of Gdynia Maritime University proves that, despite the likely absence of major ice, the said site is within the zone of first winter storms and extremely poor visibility conditions.

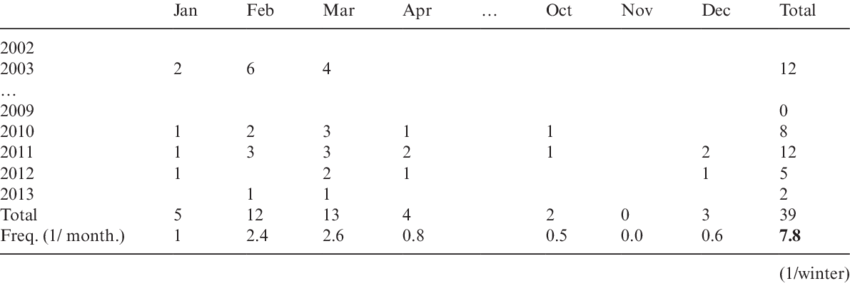

The following table from the research shows that November is the last month when emergency occurrences in the Baltic Sea are observed before a 4-month period of maximum rates (over 1). Besides, navigation recommendations and rules state that magnetic disturbances are observed in the area of Bornholm, which makes compass alone insufficient for navigation. There are also warnings regarding rocky coasts.

Therefore, it is unlikely that Gazprom will succeed before December 31, 2019, in laying the pipe across the Baltic Sea in line with all regulations with a single pipe-laying vessel at hand.

If the company employs two ships approaching each other from opposite directions, this will constitute a safety violation aimed at achieving business objectives. According to modern standards and recommendations, connecting and laying the two ends of the pipeline thread, although permitted, is considered a risky endeavor due to a high load in the process of lowering it to the sea bottom. Given the complex environment in the Baltic Sea bottom in the area where the pipeline is being laid, as well as a close proximity to explosives and chemical munitions dumping sites, such operations amid winter storms pose significant risks, in particular, to the integrity of welded joints.

Once the pipe has been laid, a full range of works is yet to be done, including connection to a gas pipeline in German waters. This procedure, taking into account restrictions related to noise insulation and welding operations in March-April, will be take place no earlier than May.

After pipe-laying has been completed, Gazprom must go through a lengthy phase of project commissioning and obtain all necessary permits from hosting states. The process could take up to two to three months. Thus, most realistically, the Nord Stream 2 pipeline will be commissioned in the third quarter of 2020.

The Nord Stream 2 reaching an annual capacity of above 30 billion cubic meters will only be possible after the completion of the second string of the Eugal line. On the project’s official website, a rather complex definition of the commissioning date has been posted. The first string is built to the end of 2019 and then put into operation. The second string will be built in subsections at the same time. However, the second string will only be fully completed about a year later and will be able to start operating afterwards. Thus, with a high probability, the commissioning deadline has been set for the end of 2020.

The situation around Turk Stream is developing in a similar manner. Two strings have already been constructed with a 15.75 bcm capacity to meet the needs of Turkey and other Southern European states. However, Bulgaria, an important gas supply chain, started the pipeline construction as late as October 2019. This will allow completing the construction only at the end of 2020 and launch at full capacity by around 2021. So far, Russia is unable to meet its gas supply commitments to Europe without the Ukrainian gas pipe.

Given that Gazprom won’t manage to launch the pipe by the end of 2019, its blackmail and pressure on the EU to conclude a short-term 12-month deal will undermine Europe’s energy security. Russia’s rhetoric is aimed at making the EU, as a market with the prospect of steady demand growth, reject the alternative gas supply routes. Gazprom sees direct deliveries to consumers its priority. Therefore, the company sees its key policy in making customers abandon U.S. LNG supplies and eliminating the Ukrainian transit route. Volatile spot market prices for U.S. LNG and the additional cost of chilling and shipping it across the Atlantic put it at a disadvantage to Russian supply. Russia’s state-control of its energy sector – and its currency – allow it to push costs even lower if necessary to compete against U.S. LNG.

Russia has responded to the encroachment of U.S. LNG by flooding the European market, filling storage and driving down prices to test the resolve of American exporters. Prices are so low now that many U.S. exporters are losing money on European cargos.

By this scenario, Russia will gain full control of the gas markets in Northern and Central Europe, and – if they succeed in strengthening positions in Libya – also in Southern Europe. The relevant scenarios of exploiting gas deliveries for political and economic pressure alike the one the Kremlin exerted on Ukraine in 2006 and 2009 by suspending supplies will pose great risks to NATO’s energy security. U.S. President Donald Trump criticized Nord Stream 2 at the UN General Assembly as a potential threat to the energy security of Europe and the economic prosperity in Ukraine.

Russia is close to becoming a regional monopolist, it will gain even higher revenues from providing gas, which, according to the Polish foreign affairs ministry, “will strengthen Russia’s ability to pursue an aggressive policy.” Furthermore, as the ministry emphasized, Nord Stream 2 “can be used to expand Russia’s ability to increase military presence and activities in the Baltic Sea region, which in turn may affect the freedom of NATO’s operations there.”

The potential increase in gas volumes flowing through Germany will allow Berlin to count these volumes in economic planning and implementing the policy of nuclear energy and coal consumption cuts. Such an increase of the German economy’s dependence on Russian gas will in just a few years lead to Russia being able to use gas deliveries as leverage over this economy, which will lose opportunities for swift energy diversification.

Russia seeks to ties economic issues to the political process, which once again proves that all of Russia’s gas transmission routes bypassing Ukraine are solely political projects.Energy is central to Russia’s foreign and economic policies with the Kremlin’s political power closely tied to its ability to use revenues from oil and gas sales to fund social and military spending. “