Poland is moving forward with the Baltic Pipe project, a natural gas pipeline that will connect gas fields on the Norwegian shelf in the North Sea to Denmark and Poland.

Operating pipeline will undermine Russia’s monopoly at the European natural gas market and mitigate political leverage risks while making decisions through energy supplies.

Baltic Pipe is a joint venture between Gaz-System and its Danish counterpart, Energinet, and will cost between Eur1.6-2.1 billion. Apart from the 275 km Baltic Sea pipeline, the project will also include the expansion of the Danish grid and a connection to Norway’s Europe II pipeline in the North Sea. It will be launched in October 2022, the same year Polish PGNiG’s gas supply contract with Russia’s Gazprom is set to expire.

Baltic Pipeline will consist of five key segments: North Sea Offshore, Onshore Denmark, Compressor Station Denmark, Baltic Sea Offshore and Onshore Poland. It will become operational in October 2022 and its capacity will be 10 bcm of gas per year. The project involves two offshore pipeline segments with a combined length of 385km in the North Sea and Baltic Sea, two onshore pipeline segments of up to 570km length in Denmark and Poland, and a compressor station at Zealand in Denmark.

On May 7, 2020, Sweden’s government approved construction of Baltic Pipe gas pipeline in the Swedish exclusive economic zone (EEZ) in the Baltic Sea. The permit for laying the gas pipeline issued by the Swedish Ministry of Enterprise and Innovation thus finishes the process of obtaining construction permits for all sections of Baltic Pipe in all the countries it will go through. Earlier, the complete set of administrative decisions had been obtained in both Poland and Denmark. The pipeline route in the Swedish EEZ will be 85 km long.

EARLIER, On April 30, Polish gas grid operator Gaz-System inked a contract with Italian oil services group Saipem to build a section of the Baltic Pipe between Denmark and Poland. Alongside the Świnoujście liquefied natural gas terminal and a new, planned facility in Gdańsk, Poland is making gradual steps towards independence from Russian energy flows. Besides, through the Northern Gate, Poland will in the future be able to reexport gas to neighboring states.

At the heart of the Northern Gate plan is to allow Poland to bring 17.5 bcm of gas into the country.

The Baltic Pipe is part of Poland’s plan to replace Russian gas supplies with alternative sources. Indeed, the Polish government announced last year that it would work toward eliminating all Russian gas from its supplies.

The Baltic Pipe project (BPP) is unwelcome for Russia, whose economy relies heavily on energy sales. The Baltic Pipe is unlikely to compete with Nord Stream 2 in terms of capacity. NS2 total capacity is 55 billion cubic meters per year and this is incomparable with 10bcm per year of BPP. But BPP carries a severe blow to Russia’s current position as a leading gas supplier in Central and Eastern Europe. Furthermore, the Baltic Pipe will serve as a key link of the North-South Corridor –– as part of the Three Seas Initiative.

Baltic Pipe crosses both the Nord Stream 1 and 2 pipelines in Danish waters so it requires the approval of the operators of both Nord Stream pipelines to do so.

Polish analysts have warned of the potential for delay in obtaining approval from the wholly-Gazprom operated Nord Stream 2 project. In last December, Gaz-System and Gazprom agreed the technical conditions for the crossing of Baltic Pipe and Nord Stream 2, but it could be a trick to accelerate the construction of NS2.

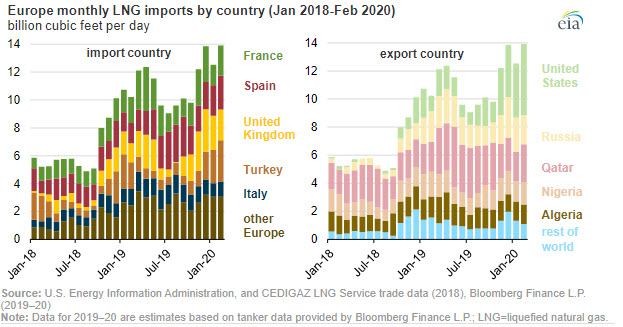

Attempts to slow down the BPP construction might be counter-balanced by increased pressure on NS2, as well as the BPP expansion with American LNG. NS2 effectiveness is jeopardized over Germany’s Federal Network Agency (BNA) rejecting the NS2 application for exemption from the amended EU Gas Directive. Therefore, Gazprom will be able to use just 50% of the pipeline’s capacity.

Russia is trying for alternate solutions these days. The possible discussed solutions are the following:

– additional pipe string providing the planned transit capacity even subjected to a 50% limit;

– to set up a joint venture management company operating NS2 or its final section,

– capacity reservation auctions, held by this company,

– a virtual hub in the Baltic Sea,

– to sell gas to customers at the NS2 entrance in Russia.Russia believes that, providing Gazprom alone is allowed to export gas under Russian laws, the pipeline might be sold to partners to circumvent the amended EU Gas Directive so that Gazprom does not hold majority of shares. Nevertheless, Russia will not be able to use shell Russian companies in this case over the project costs. Berlin is unlikely to come up with such company as well. China, having sufficient financial resources, is unlikely to be admitted to the deal by Germany.