Russia’s ongoing policy to monopolize the European energy market through Nord Stream 2 gas pipeline cannot but remain a subject of deep concern for the United States, as it infringes on the U.S. interests and threatens the NATO’s security.

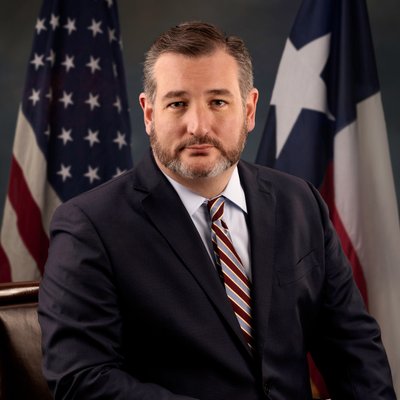

Senator Ted Cruz, (R-Texas) said that if Akademik Cherskiy pipe laying vessel, owned by Gazprom Fleet LLC (a wholly owned Gazprom’s subsidiary), started operating, American sanctions would be imposed against all companies involved in the construction and their ultimate parents. A statement by Senator Cruz should be a signal to consolidate Congress to guard the U.S. interests.

We expect that a lot of countries will continue to buy gas from Russia …but now there’s no competition. Europe can buy its natural gas wherever it wants, including Russia, but there should be more competition among suppliers.

“Is there transparency in pricing, is there even a market, you can’t possibly have a market if you have one supplier — that’s not a market, there’s no competition.”

Frank Fannon, the U.S. assistant secretary of state for energy resources

Europe has already come to plan for imposing the sanctions against Gazprom. For example, Turkey, aware of the implications, has already been curtailing gas supplies through Russian pipelines in favor of LNG supplies from alternative sources. Such supplies are cheaper and safer, as the Kremlin’s interests have obviously diverged from Ankara’s ones more recently, especially in Libya.

The European countries are highly probable not to even refer to the sanctions while curtailing Russian gas supplies, so as not to fray relations with the Russian Federation itself in view of the extraneous Russia’s policy but to bill cheaper LNG as a reason to change the supply source.

“By a vote of 433-105, the members of the European Parliament called for the project to be cancelled because, ‘It is a political project that poses a threat to European energy security and the efforts to diversify energy supply.”

Senator Ted Cruz, (R-Texas)

Simulated event suggests that Gazprom is unlikely to avoid sanctions, even if it decides to sell some other Russian vessels involved in the project to protect itself in this way. The sanctions’ wording deliberately leaves room for interpretation, its breadth fed on the political factors and allows for the vessels’ seller, i.e. Gazprom itself, to be sanctioned. To raise the sanctions’ effectiveness, Gazprom should become toxic not only as a transit company but as a supplier too. Cooperation with Gazprom should become dangerous, and pose a threat to any of its partners.

Nord Stream 2 AG project company should submit a new work plan to the Danish Energy Agency before the actual construction starts, specifying the fleet involved and all proper documentation, including vessels’ insurance and pipe laying. Just a few companies in the world give such insurance, most of them under friendly-registered jurisdiction.

Thus, the risks for insurance companies to fall under the U.S. sanctions should exceed the potential earnings from Gazprom. Russian insurance companies do not have the essential status and credibility by the Danish regulator. Consequently, the lack of necessary insurance for both the vessel and the works in such dangerous area as the island of Bornholm de jure should translate into a negative decision by the Danish regulator.

The U.S. sanctioned Iran is plagued by similar problems over the insurance for its tankers, this entailing a sharp drop in Iranian oil exports. In the case of Iran, oil supplies did not drop to zero, as some countries far from Western values are ready to accept Iranian tankers without insurance, but Denmark is unlikely to leap in the dark, especially amid high environmental risks for Copenhagen.

Gazprom could not even insure the works at Academik Cherskiy for further required diameter pipe laying. Tenders have been rescheduled for more than 5 months and the prospects to find an underwriter even for such work are rather vague.

Open source analysis and the insider insights from Russia allow to predict that Gazprom might use its two ships simultaneously in case it fails in finding the underwriter. Given that Fortuna pipelay crane vessel does not have a dynamic positioning system, but is geared to lay pipes of the required diameter, and Academik Cherskiy has a dynamic positioning system, but cannot lay pipes for NS-2, the vessels can be used together by ship-to-ship method. Thus, it would be possible to use Cherskiy’s remote positioning system and Fortuna’s pipe laying technique.

Meanwhile, Denmark in highly doubtful to agree to such conditions. According to reports, Gazprom initially tried to convince the DEA to use Fortuna pipe layer along with auxiliary vessels equipped by remote positioning system, but the Danish regulator did not agree to such conditions, considering that the risks exceeded the tolerable ones. The same answer is likely to await a similar scheme using Cherskiy and Fortuna.

European environmental organizations emphasize that codfish spawns near Bornholm Island in July-August and any work in that area is prohibited at that time. Given that it will take at least 3 months to lay the gas pipeline (160 km, with a laying speed of 1.5-2 km per day), Gazprom will no longer be able to start further construction. Thus, construction might resume not earlier than in autumn. By that time, BalticPipe gas pipeline construction will have already started, supplying gas from Norway to Poland. Based on the fact that pipes for BalticPipe are already being manufactured, laying work might start as early as the fall of 2020 just as codfish spawning is over. Considering the fact that the gas pipeline is just 275 kilometers long, Italian Saipem, the contractor for the project, with more than enough experience in this region, will be able to fit in less than 2 months. Thus, the Danish regulator is most likely not to allow the simultaneous implementation of two cross-projects, in view of technological safety. The preference would more than likely be given to BalticPipe with regard to political factors.

As a result, provided all obstacles gone through, Gazprom might not be able to resume construction till December, when weather patterns and storms will complicate the work.

Gazprom’s supplies have already fallen by 19% through the 1st quarter of 2020. For the first time in its existence, Gazprom reported on losses for the quarter, amounting to more than 306 billion rubles, or 4.2 billion dollars.

Escalating Gazprom’s problems will go to temper the Kremlin’s aggressive extraterritorial policy and cut down spending on military campaigns and arms programs. End of Gazprom’s monopoly at the European market will also increase the stability of energy supplies to the European market and eliminate Russia’s political leverage and corruptive meddling in the European Union.

We have to continue to encourage countries to be open to diversification goals, build the infrastructure necessary to transport energy across Europe. But even if they choose to purchase from Russia they’ll be better for it because their citizens will pay less.”