Representatives of elite, politics, and economics, as well as investment activity players of Russia constitute an inextricable system. Their activity serves as one of the best indicators showing the situation inside the country and its relationship with other states.

At the end of 2019, Russia’s overseas investments increased. In a single year the growth reached $64.7 billion and, eventually, amounted to $500.6 billion for the whole investment period. However, capital participation, $390.7 billion, dominates in the structure. Debt instruments amount to $109.9 billion. Over the past year the Russian Federation has increased significantly its investments in the UK (+$10.8 billion), Ireland (+$1.6 billion), Germany (+$747 million) and Serbia (+$649 million). At the same time, last year the largest investment outflows were observed in the Netherlands (-$4.3 billion), Turkey (-$2.2 billion) and Switzerland (-$1.7 billion). Russia’s investments in at least two key foreign jurisdictions, Serbia and Turkey, are strong-geopolitically charged. Serbia is a traditional ally of the Russian Federation, and the Turkish leaders’ conflict with the Kremlin.

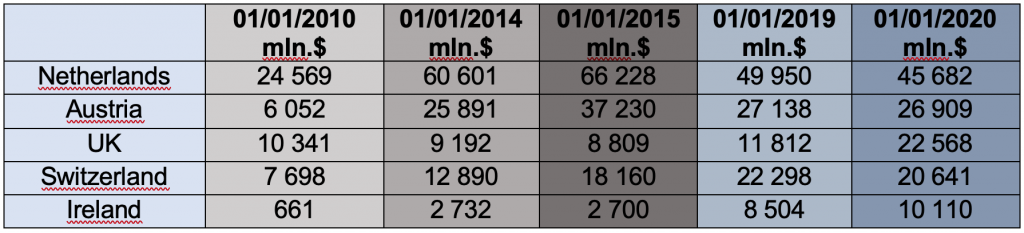

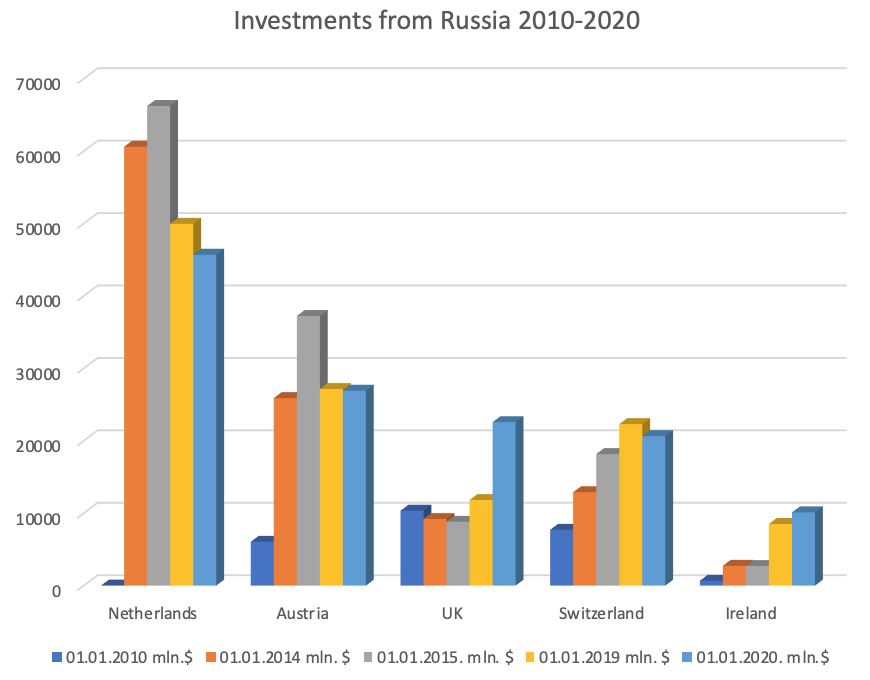

For the past 10 years overseas investments of the Russian Federation have grown 1.7 times, from $298 billion to $500.6 billion. During the past 10 years TOP states have been invested the most, besides offshore jurisdictions, is the following.

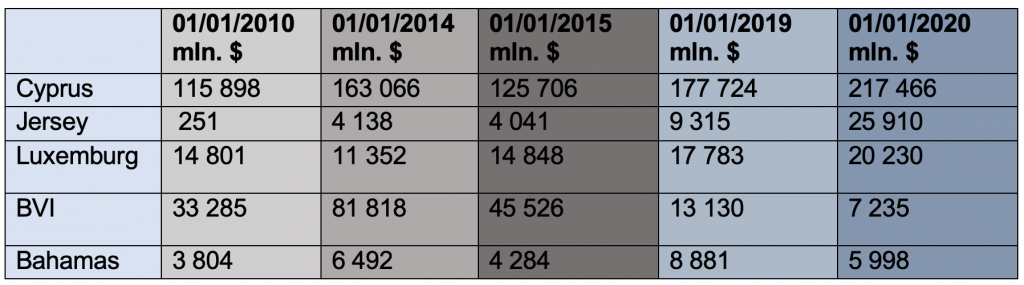

Basically, these are ‘white’ tax havens the Russian Federation’s elite used. Over the past 10 years they have withdrawn $76.6 billion.

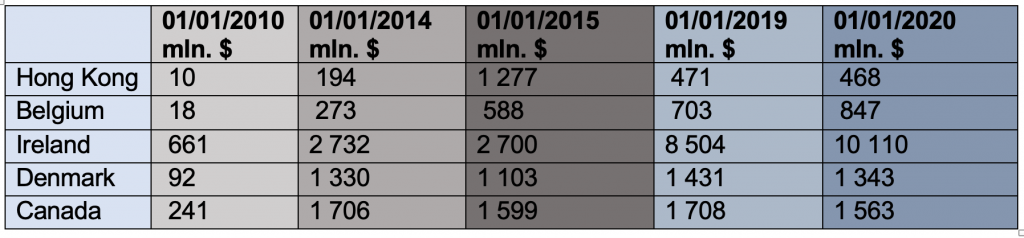

In the meantime, the list of the states on Russia’s investment funds growth dynamic, besides offshore jurisdictions, for 10 years includes:

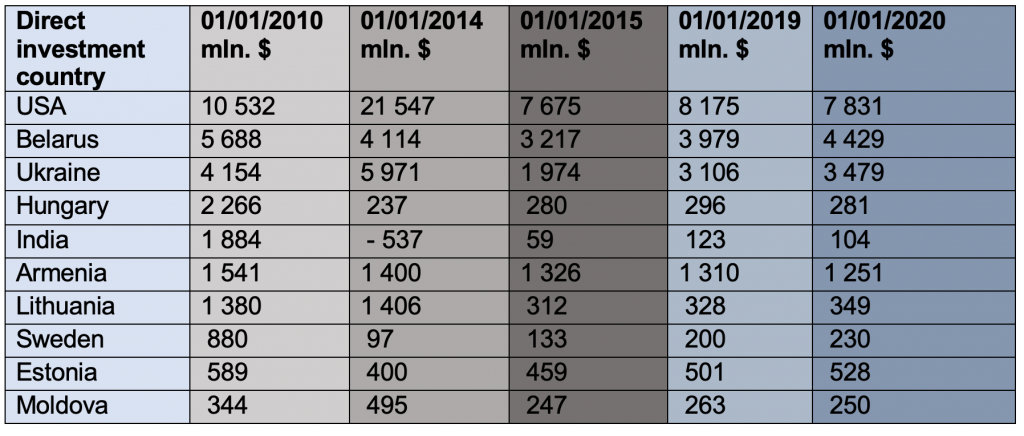

Over the past 10 years there is a reverse trend such as Russian investment outflow.

In this case, the investment volume is directly connected with the conflict between countries, in particular, the USA, Ukraine, Lithuania, Sweden, Estonia and Belarus. Listed Moldova and Armenia are two countries that Russia sees as direct investment countries, however, both of them are experiencing Russia’s investment inflow reduction. Against the backdrop of attempts at active political cooperation, Russia is reducing investments in Hungary and India that, in turn, clearly demonstrates the essence and level of relationship. However, the Russian Federation’s offshore investment growth impresses the most. At the end of 2019 this indicator amounted to $274 billion. At the same time, the Russian Federation’s funds withdrawal accelerated significantly: a year growth reached $42 billion, a 10-year’ growth amounted to $88 billion. The lion’s share of offshore investments falls in Cyprus ($217 billion and + $39,7 billion per year). This level of offshore investments is almost the same as on January 1, 2014. TOP-5 offshore jurisdictions where the elite of the Russian Federation withdraws the most funds as follows:

In the meantime, Russian investors are extremely active in ‘white’ tax havens, mainly, the UK and Ireland. The heavy increase of the mentioned above indicators perfectly shows the mood of the Kremlin and the Kremlin-close elite, including law enforcement agencies. This tendency demonstrates a fear of the negative scenario of the situation development, primarily, inside the country. We expect that by the end of 2020, the situation will further intensify amid the events in the Russian Federation and low energy prices.