Chinese companies are supplying components for Russian military drones, which may shed light on Beijing’s interests in prolonging the war in Ukraine and avoiding pressure on the Kremlin to end the conflict. These supply chains allow Russia to maintain its UAV production and military operations, raising questions about China’s true geopolitical motivations.

By supporting Russia’s drone capabilities, China indirectly contributes to Moscow’s military aggression, despite its public stance of neutrality and calls for peace. Beijing’s reluctance to exert pressure on Russia could indicate a strategic interest in keeping the West distracted and divided, as well as ensuring access to Russian resources and maintaining a partnership against Western influence.

This dynamic suggests that China might see the continuation of the conflict as beneficial for its long-term objectives, avoiding direct involvement while gaining from the geopolitical instability. By balancing diplomatic rhetoric with actions that support Russia, China maintains its influence without openly aligning with Moscow’s military agenda.

China is a major player in today’s global arena, a nation that emerged from a difficult period at the turn of the 19th and 20th centuries to enter the new millennium as an economic powerhouse. While China’s success can be attributed to many factors, much of it stems from its expansion into global trade. The entrepreneurial spirit and hard work of the Chinese people, bolstered by Western investment, have yielded impressive results. Today, Chinese-made goods are no longer synonymous with cheap knock-offs but are recognized for their innovation and quality.

China’s growing economic strength has naturally raised questions about its role on the world stage. The G7 nations have acknowledged the necessity of involving emerging economies, particularly China, in global economic discussions and decision-making. This was formalized in December 1999 with the creation of the G20, where China now stands as a heavyweight, shaping not only economic but also political agendas. Additionally, China is a leading member of the BRICS group of nations.

The rise of China has shifted the balance of power in the global economy, leading to increased political competition. Beijing aims to reshape the rules of international economics and politics to fit its vision but faces resistance from the established global leaders. Europe and the United States, for their part, seek to maintain the existing order. In this struggle, which sometimes flirts with the line between competition and confrontation, China is looking for allies. Notably, it finds support among countries labeled as “bad actors” in the West, with Russia being the foremost among them.

While Beijing has not explicitly condemned Russia’s aggression against Ukraine, it calls for a peaceful resolution and recognizes the primacy of the UN Charter. However, China plays a crucial role in supporting the Kremlin’s war efforts in Europe. NATO Secretary-General Jens Stoltenberg openly acknowledged this on September 6. As a global power, China cannot afford to supply weapons directly to an internationally recognized aggressor. Nonetheless, critical goods continue to flow from China to Russia, aiding its war machine. Of particular concern are the components needed to manufacture various types of drones used by Russian forces, as drones have become a key factor in the conflict between Russia and Ukraine.

Officially, Beijing denies supplying Russia with drones or military-use components. In 2023, China imposed export restrictions on drones, initially complicating their supply to Russia and creating shortages of certain parts. However, as in other sectors, Russia has found ways around these restrictions by using third countries and exploiting loopholes.

As of September 1, China introduced further export restrictions on drones and electronics, targeting even more components critical for UAVs. The Chinese Ministry of Commerce stated that these restrictions do not amount to a ban and that the products can still be sold for civilian use.

However, it is not the declarative statements but concrete actions that are crucial to ensuring strict adherence to these bans. Consequently, given the Russian military’s reliance on Chinese electronics and Russia’s experience in sourcing goods through third countries, it would be misguided to assume that yet another Chinese ban will prove effective.

At the same time, well-established supply channels for components from China to Russian drones have long been in place and continue to operate successfully. The open question remains the extent of the Chinese government’s awareness of these channels and the degree of oversight by Chinese intelligence services.

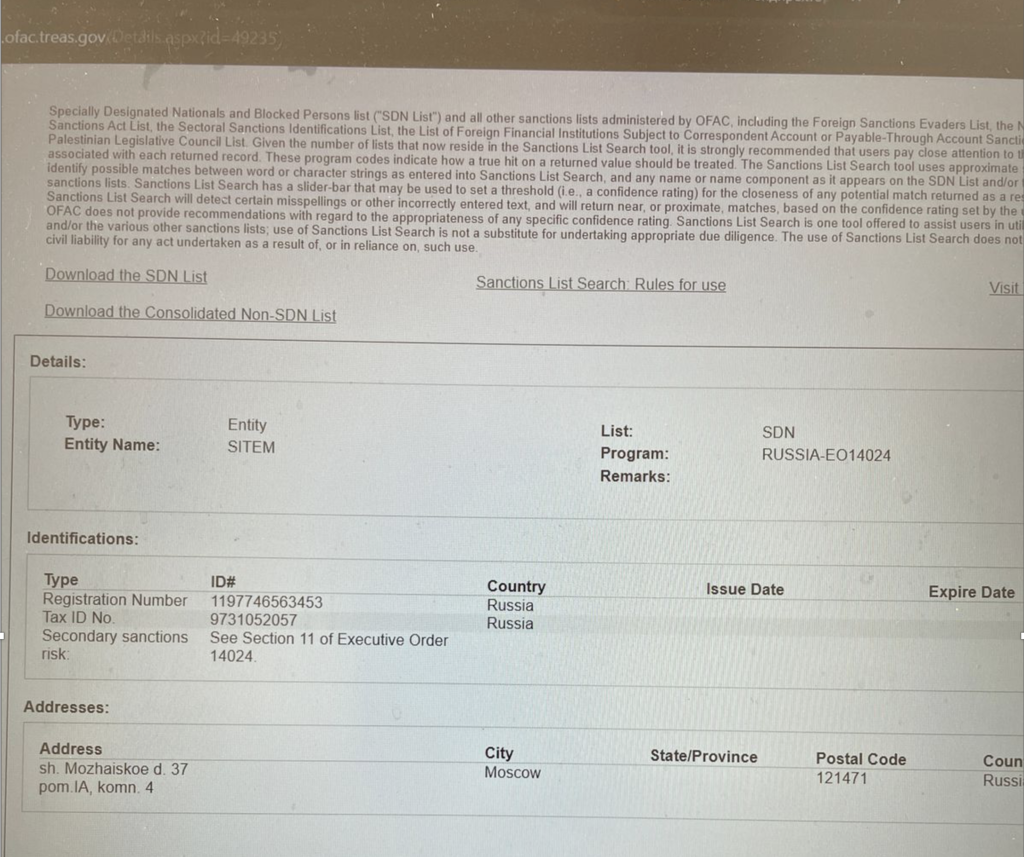

One of these channels is evidenced by an analysis of publicly available online data on the operations of the Russian company “SITEM,” which was registered in 2019, has an office in Moscow, and has been under U.S. sanctions since June 2024.

In 2023, “SITEM” saw its revenue grow by 131.1% compared to 2022, nearing 1 billion rubles. This surge was driven by the supply of specialized goods from China.

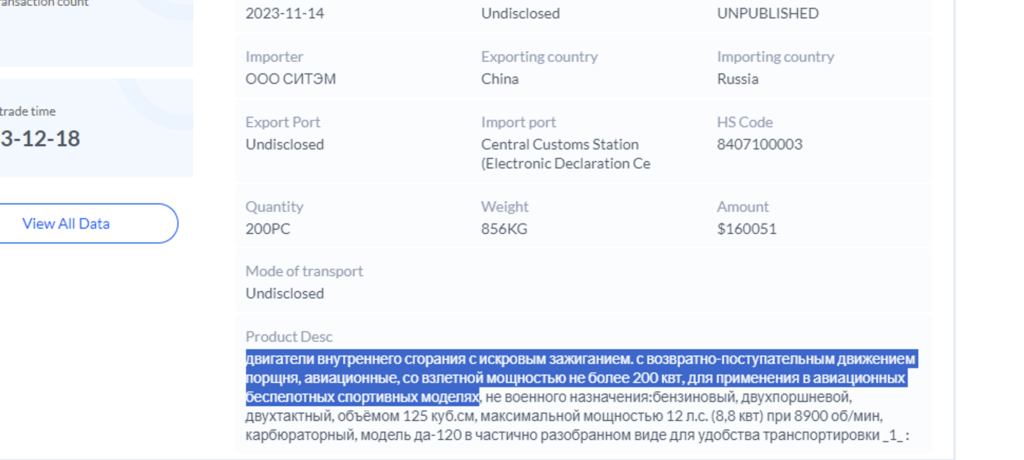

On the Russian market, “SITEM” positions itself as a manufacturer of technical and software solutions designed to protect enterprises from threats related to fires, industrial disasters, unauthorized access, and safety violations. However, data from international trade databases reveal that “SITEM” has been involved in the supply of components for drones from China to Russia, including internal combustion aircraft engines, surveillance cameras, and microelectronics.

This surge was driven by the supply of specialized goods from China.On the Russian market, “SITEM” positions itself as a manufacturer of technical and software solutions designed to protect enterprises from threats related to fires, industrial disasters, unauthorized access, and safety violations. However, data from international trade databases reveal that “SITEM” has been involved in the supply of components for drones from China to Russia, including internal combustion aircraft engines, surveillance cameras, and microelectronics.

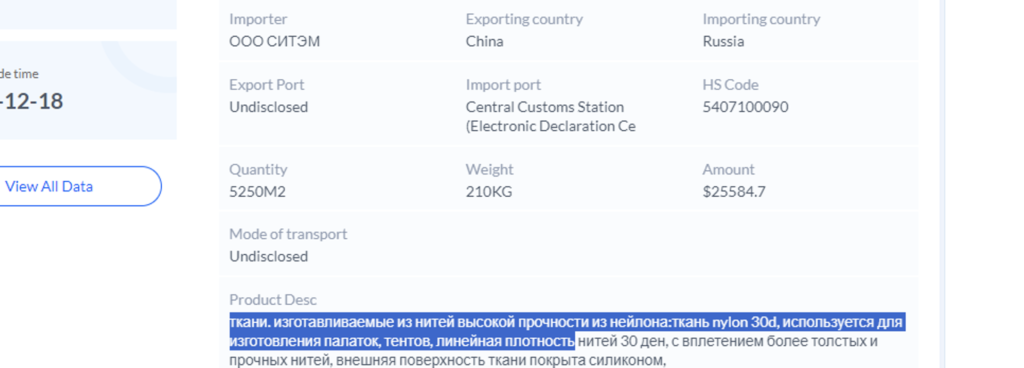

The Russian company has also imported carbon products from China for use in unmanned aerial models.

Yet, the real issue lies in whether these restrictions will be strictly enforced. Given the Russian military’s reliance on Chinese electronics and Moscow’s experience in bypassing sanctions through third countries, it would be naive to assume that the latest restrictions will be effective. Well-established supply channels from China to Russia for UAV components have been in place for some time and continue to function. Whether Chinese authorities are aware of these channels or to what extent they are monitored by Chinese intelligence remains unclear.

One such channel has been revealed through the analysis of publicly available data on the activities of the Russian company SITEM, which was established in 2019 and has an office in Moscow. In June 2024, it came under U.S. sanctions. In 2023, SITEM’s revenue grew by 131.1% compared to 2022, nearing 1 billion rubles, driven by the import of specialized goods from China.

Among the suppliers of these types of products are two Chinese companies. The first, “GUANGZHOU DUPRE EXPORT & TRADING CO LTD,” exports exclusively to Russia and exhibits characteristics of a company created to facilitate the export of dual-use goods, bypassing sanctions. The company is not under international sanctions. However, it collaborates with the Russian firm “BESPILOTNYE SISTEMY,” which has been under U.S. sanctions since 2022. This Russian company develops unmanned aerial vehicles (UAVs), optoelectronic systems, and software under the “SUPERCAM” brand. The Supercam S350 reconnaissance UAV is actively used in the war against Ukraine, performing critical military functions in surveillance, intelligence gathering, and targeting for fire systems.

While SITEM markets itself as a provider of technical and software solutions for fire safety and industrial security, international trade data indicates that it imports drone components from China, including internal combustion engines, surveillance cameras, and microelectronics. Carbon fiber products for unmanned aerial vehicles are also among the imports from China.

The importance of “UNMANNED SYSTEMS” for the Russian military was underscored by a visit in February 2024 to an enterprise by then-Russian Defense Minister Sergei Shoigu. One of the company’s founders, Maksim Shinkevich, is a regular participant in meetings held by the Russian Ministry of Defense focused on UAV technologies.

A second Chinese company, HMK TRADING COMPANY LTD, which is also not subject to sanctions, supplies internal combustion engines with forced ignition and rotary piston internal combustion engines to Russia through SITEM. These engines, labeled iFlight iPower GM5208-12, form the backbone of the Russian Supercam S350 UAV. This is in stark contrast to the Chinese firm’s specialization, which is the “integrated supply of a wide range of consumer goods, including tools, finishing materials, household appliances, auto parts, equipment, and electronics.” Russia remains its largest market.

In addition to SITEM, the products of HMK TRADING COMPANY LTD are imported into Russia by the Russian firm KVANTUM (9723041421). This firm provides contract manufacturing services for printed circuit boards and operates in Russia, Moldova, Kazakhstan, Belarus, Uzbekistan, Azerbaijan, Kyrgyzstan, Tajikistan, and Armenia.

Two Chinese companies stand out as key suppliers.

Thus, the sanctioned Russian company SITEM continues to import components from China without impediment, which the company Unmanned Systems may subsequently use in the production of UAVs of both airplane and helicopter types. Notably, the Chinese companies involved do not conceal their trade with sanctioned Russian firms.

It is important to highlight that there are countless such supply chains of sanctioned goods from China to Russia, with shipments numbering in the thousands. These deliveries encompass not only engines for UAVs but also the broader component base, including electronic boards, microcontrollers, and body parts, among others.

Since the start of the war, Russia has deployed approximately 14,000 strike drones and over 15,000 missiles, leading to significant destruction of civilian infrastructure and numerous civilian casualties. According to BBC reports, the Russians are actively using reconnaissance drones to infiltrate deep into Ukrainian territory, where they target critical facilities and direct ballistic missile strikes. This tactic has been enabled by continuous modernization and the mass use of Orlan, Zala, and Supercam drones, in combination with Iskander missile systems or other platforms. Typically, Iskander strikes on Ukraine frequently result in civilian casualties and damage to civilian infrastructure—something a representative from China at the UN specifically urged to avoid.

The ongoing flow of supplies to Russia that bolster its military capabilities raises questions about China’s true interests in the continuation of the war in Ukraine. Despite Beijing’s reassuring official statements, the facts point to the continued supply of goods to Russia that are used in the conflict against Ukraine. For a country that aspires to global leadership and frequently criticizes the West for double standards, it would be prudent for China to pursue a consistent and responsible policy. The coming months will reveal whether China is a sufficiently responsible geopolitical player to keep its word, and whether it will continue supporting Russia in exchange for Moscow’s assurances of friendship against the West.

The existence of these supply chains, allowing sanctioned goods to flow from China to Russia, casts doubt on China’s true stance regarding the war in Ukraine. Despite its official statements advocating peace, the evidence suggests a more complex reality, with Chinese goods playing a role in Russia’s military efforts. As China seeks to position itself as a responsible global leader, it will need to address these contradictions. The coming months will reveal whether Beijing is willing to uphold its commitments or continue supporting Russia in exchange for assurances of friendship against the West.

China should remember that its cooperation with Europe and the U.S. has brought significant economic benefits, whereas Russia’s promises have proven hollow. Moscow, after all, betrayed Ukraine despite decades of professed friendship.

Pingback: China Continues Supplying Russia with Critical Dual-Use Components - Robert Lansing Institute