Russia’s involvement in building a gold refinery plant in Mali is not just an economic move — it’s a strategic maneuver involving sanctions evasion, geopolitical influence, and shadow financing of military operations in Africa and beyond.

Russia’s Gold Plant in Mali: A Strategic Move

What’s Happening?

In 2024–2025, Russia, via its state-connected entities and shadow firms, began construction of a gold refinery plant in Mali, with the stated goal of helping the country “regain control over its natural wealth.” In reality, this is:

- A geopolitical investment.

- A sanctions evasion mechanism.

- A tool of informal trade and resource control.

Why Now?

1. Sanctions Pressure & the Search for “Clean” Gold

- Since 2022, Russian gold exports to the West have been sanctioned (U.S., UK, EU ban on Russian-origin gold).

- Russia is turning to Africa to launder and re-export gold under third-party origin labels.

- Mali is not under gold sanctions, creating a loophole.

2. Control Over the Malian Junta

- Russia has become the main security provider in Mali via Wagner (now under the Africa Corps label, Russia’s MoD).

- The refinery deepens dependence on Russia, locking in strategic vassalage through economic tools.

3. Resource-Backed Diplomacy

- The plant offers Russia access to physical gold as hard currency — useful for arms deals, covert payments, and funding its foreign operations outside the SWIFT system.

Who Are the Beneficiaries?

1. Russian State & Wagner’s Successors

- Gold is used to pay Wagner/Africa Corps operatives, fund covert missions, and bypass Western financial systems.

- Kremlin-aligned firms gain exclusive export rights, storage, and offshore resale through Dubai, Turkey, and East Asia.

2. Malian Junta

- Gains a domestic refinery (nominally sovereign), but likely under Russian operational control.

- Receives military and political support in return for strategic access to Mali’s mineral wealth.

3. Global Gold Middlemen

- Traders in the UAE, Türkiye, and China profit by relabeling African gold as non-Russian origin.

- Smuggling networks expand, weakening transparency in global gold supply chains.

Other Russian Gold Extraction Projects in Africa

| Country | Activities | Russian Actor(s) | Notes |

| Sudan | Mining and refining | Meroe Gold (linked to Wagner) | Used to finance Russian paramilitary presence |

| Central African Republic | Artisanal mining control | Wagner-linked firms (Lobaye Invest) | Revenues used for military & political influence |

| Madagascar | Legal/illegal mining | Unofficial Russian proxies | Also used for political manipulation |

| Zimbabwe | Legal joint ventures | Russian private firms + ZANU-PF elites | Strategic partnership but limited in scale |

| Guinea | Potential exploration | Rosgeo, other parastatals | Under negotiation, with strategic aim |

How It Affects the Gold Market

1. Undermines Transparency

- Russia injects “African gold” into global markets, bypassing “conflict-free” sourcing standards (e.g., London Bullion Market Association).

- Threatens market trust, especially in Europe and North America.

2. Supports Parallel Economy

- Enables black-market and “gray gold” trades, fueling illicit finance, terrorism, and sanctioned regimes.

3. Creates Supply Glut in Some Markets

- Oversupply of repackaged African-origin gold can distort prices in non-Western markets (e.g., UAE, Turkey, India).

- May increase pressure on legitimate African producers by depressing local prices.

⚖️ What About Sanctions?

- The gold itself is not sanctioned if labeled as Malian, but:

- Russian individuals and entities involved are often under sanctions.

- U.S. and EU “secondary sanctions” threats may extend to firms helping Russia launder gold.

- 2024 U.S. Treasury advisories have warned gold traders in Dubai and Africa to tighten due diligence on gold linked to Wagner/Russian actors.

Strategic Implications

1. Africa Becomes Russia’s “Gold Back Office”

Russia is creating a shadow monetary ecosystem in Africa:

- Gold as a replacement for hard currency.

- Payment system for proxy wars (e.g., Syria, Ukraine) via untraceable African gold.

- “Gold-for-security” swaps with unstable regimes.

2. Undermining of African Sovereignty

- Russia’s control over strategic resources shifts sovereignty from African governments to Russian-aligned networks.

- Increases risk of internal political instability and civil conflict (especially in Mali and Sudan).

Conclusion

Russia’s gold refinery in Mali is part of a broad, deliberate strategy:

- To evade sanctions,

- To monetize its influence in Africa,

- And to build a war chest immune to dollar/euro-based restrictions.

It represents a new form of neocolonialism, where Russia trades protection and influence for Africa’s resources—especially in fragile, junta-led states.

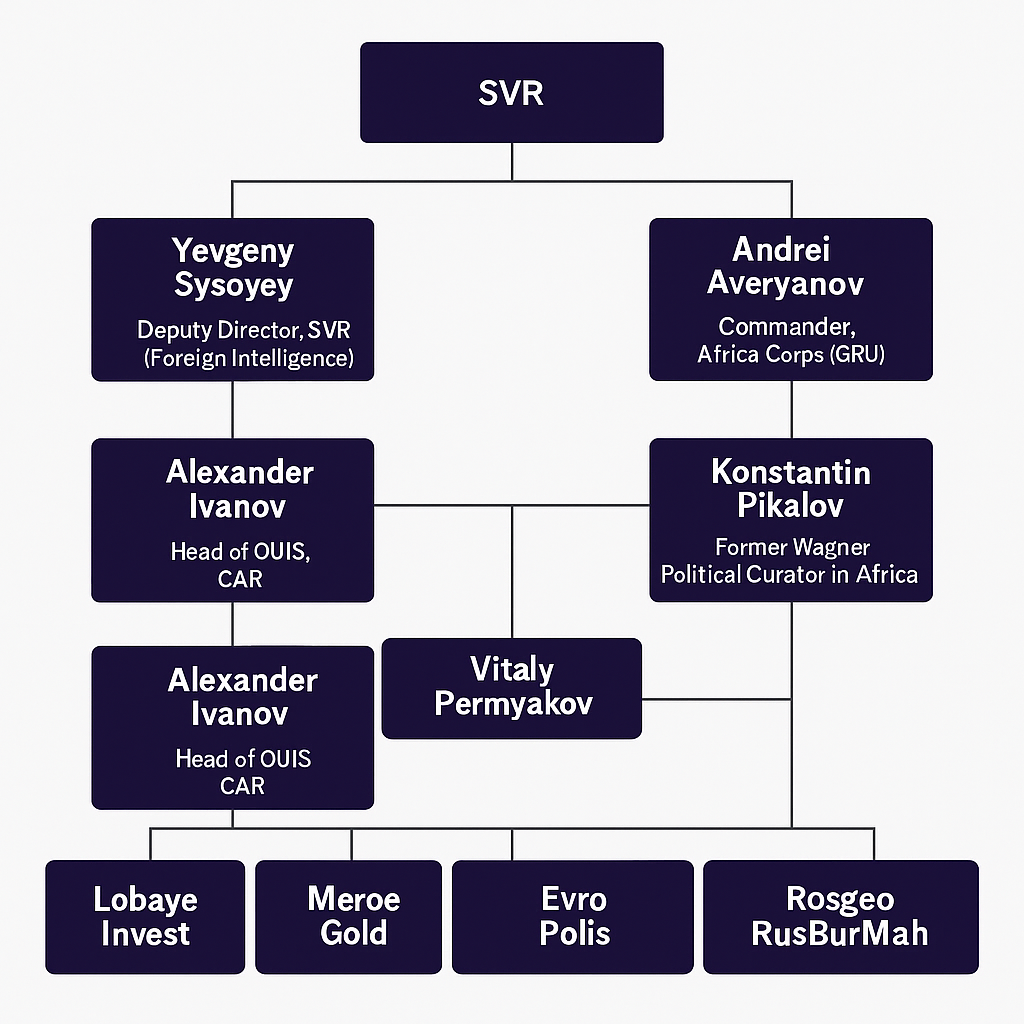

After Yevgeny Prigozhin’s death in August 2023, control over Wagner’s gold exploration and exploitation activities in Africa transitioned to a more formalized, state-supervised structure, known informally as the “Africa Corps” — a rebranded and Kremlin-controlled successor to Wagner’s expeditionary wing.

Here’s a breakdown of who controls Russian gold operations in Africa today:

1. Africa Corps (Корпус «Африка») – Kremlin’s New Tool

- Created in late 2023–early 2024, the Africa Corps is under the direct supervision of the Russian Ministry of Defense (MoD) and the Main Intelligence Directorate (GRU).

- It absorbed logistics, contracts, and personnel from Wagner’s African assets.

- Commander: General Andrei Averyanov (GRU Unit 29155), a senior intelligence officer long linked to foreign covert operations.

- Tasked with continuing Wagner’s model of security-for-resources deals, especially in Mali, CAR, and Sudan.

2. Russian State Entities and “Shell” Companies

The actual ownership and monetization of gold concessions is now handled through state-linked holding companies, often under opaque ownership. Key players:

Lobaye Invest (Central African Republic)

- Originally Wagner-controlled; now likely under Africa Corps frontmen.

- Holds licenses for gold and diamond mining.

- Profits funneled to GRU-linked networks and the Russian state treasury via offshore accounts (UAE, Cyprus, Türkiye).

Meroe Gold (Sudan)

- Used to smuggle and export gold out of Sudan.

- After the 2023 coup attempt in Sudan, operations continued under military protection, but now run by Africa Corps-backed logistics firms.

RusBurMash / Rosgeo (Exploration + Prospecting)

- Russian geological and mining firms with exploration rights in Guinea, Zimbabwe, Sudan.

- Likely used to identify future sites for Africa Corps to “secure”.

3. Russian GRU and SVR (Foreign Intelligence)

Behind the scenes, the GRU (military intelligence) and SVR (foreign intelligence) now directly manage the coordination of:

- Resource-for-security deals,

- Diplomatic cover for mining operations,

- Relations with local elites and juntas.

They ensure these operations:

- Remain deniable,

- Circumvent Western sanctions,

- Provide off-the-books income for covert ops.

4. Local Power Brokers and African Regimes

Moscow now outsources local compliance and repression to military-led regimes, especially:

- Assimi Goïta (Mali)

- Faustin-Archange Touadéra (CAR)

- Mohamed Hamdan Dagalo “Hemedti” (Sudan RSF faction)

These leaders ensure legal cover and paramilitary support for Russia’s mining operations in exchange for weapons, surveillance tech, and personal security guarantees.

Where the Gold Goes Now

- Shipped through informal or opaque routes to:

- Dubai and Sharjah (UAE)

- Istanbul

- Hong Kong and Macau

- Gold is sold for hard currency or cryptocurrencies, then used to:

- Pay Africa Corps operatives,

- Fund third-party militias,

- Procure sanctioned goods for Russia.

Conclusion

After Prigozhin’s death, Russia tightened its grip on Wagner’s gold empire. The shift to state-run military-intelligence control through the Africa Corps signals:

- More structure,

- Less rogue freelancing,

- And a deepening of resource extraction as a geopolitical weapon.

The real beneficiary is the Russian state — using African gold as an untraceable, sanctions-proof asset to fund war, buy influence, and destabilize rivals.

while much of Russia’s gold operation in Africa is veiled behind shell companies and intelligence cover, multiple Russian individuals have been directly or indirectly identified as key players in post-Prigozhin gold exploitation across the continent. These figures span from GRU and SVR handlers to Africa Corps officials and frontmen of business operations:

Key Russian Figures Involved in Gold Operations in Africa

1. Andrei Averyanov – Commander, Africa Corps (GRU)

- Affiliation: GRU Unit 29155 (covert operations), now Africa Corps.

- Role: Top military overseer of Africa Corps; directly involved in managing resource-for-security exchanges in Mali, Sudan, CAR.

- Known for: Linked to assassination plots in Europe (e.g., Skripal case). Took over Wagner field networks in 2023–2024.

- Trusted by Putin as a military-intelligence loyalist.

2. Yevgeny Sysoyev – Deputy Director, SVR (Foreign Intelligence)

- Affiliation: SVR.

- Role: Oversees SVR operations in Africa and the Middle East.

- Involvement: Believed to supervise “political penetration” efforts in Africa, including backing for resource-linked regimes and diplomatic cover for gold and arms deals.

- Note: Though he does not physically direct gold ops, his teams coordinate political access, protection, and disinformation.

3. Alexander Ivanov – Head of “Officers Union for International Security” (OUIS), CAR

- Role: Front-facing figure providing official security services to the CAR government.

- Connection: Former Wagner asset; now functions as a contractor under Africa Corps.

- Operations: Linked to protection of gold mines and logistics for resource exports via Lobaye Invest.

- Media Role: Appears in state media to portray Russian operations as “training and peacekeeping.”

4. Konstantin Pikalov (“Mazay”) – Former Wagner Political Curator in Africa

- Role: Handled local political contacts and recruitment in Francophone Africa, esp. CAR and Mali.

- Status: Still possibly active behind the scenes as liaison to African elites, but under tighter GRU control post-Prigozhin.

- Linked to: Recruitment of local militias to protect Russian mining assets.

5. Vitaly Permyakov – Business Operator and GRU Liaison (unconfirmed)

- Alleged Role: Manages shell companies and offshore accounts (especially in UAE and Türkiye) linked to gold sales.

- Involvement: Mentioned in investigative leaks (e.g., Dossier Center, Bellingcat) as part of Russia’s “shadow financial routes.”

- Cover: Often presented as a logistics or trading consultant.

🧩 Entities & Front Companies Used by These Individuals

| Entity | Country | Function | Connected To |

| Lobaye Invest | CAR | Gold/diamond mining | Ivanov, Pikalov |

| Meroe Gold | Sudan | Gold refining/export | GRU-Africa Corps |

| Evro Polis | Syria/Africa | Resource-for-security contracts | MoD-linked |

| Rosgeo / RusBurMash | Various | Geological surveys | GRU oversight |

| Africa Corps | HQ in Moscow | Paramilitary + logistics | Averyanov |

Intelligence Observations & Confirmations

- Dossier Center, Bellingcat, and All Eyes on Wagner have published geolocations, contracts, and testimoniesfrom insiders and diplomats.

- Western intelligence agencies have named Ivanov and Pikalov in classified memos as key operatives maintaining continuity of Russian gold pipelines after Wagner’s restructuring.

- SVR handlers, unlike GRU officers, rarely appear publicly — but figures like Sysoyev provide the diplomatic arm and strategic direction for these operations.

Why This Matters

- These individuals run an ecosystem that allows Russia to extract, launder, and weaponize gold:

- To fund war (Ukraine),

- To sustain foreign policy (Africa, Syria),

- And to build economic resilience against Western sanctions.

Estimated Annual Revenue Russia Derives from African Gold & Minerals

1. Gold: $2.5–3.5 billion annually

Russia’s most lucrative resource from Africa. Key countries: Sudan, Mali, CAR.

| Country | Estimated Annual Value (USD) | Notes |

| Sudan | $1.1–1.5 billion | Meroe Gold + smuggling routes; ~30–40 tons/year |

| Mali | $800–1,000 million | Recent refinery project; 20+ tons/year potential |

| CAR | $300–400 million | Mostly artisanal mining, controlled via Lobaye Invest |

| Others (e.g., Guinea, Zimbabwe) | $200–300 million | In development or small-scale exports |

→ Total (gold only): ~$2.5–3.5 billion/year

Much of this gold is smuggled to Dubai, Türkiye, or Asia, then resold as “clean.”

⚒️ 2. Diamonds: $300–500 million annually

Primarily from the Central African Republic, where Russian operatives oversee diamond fields near Berengo and Ndassima. Though not a dominant global player, the margin per stone is high due to illicit export.

3. Other Minerals: $200–400 million

- Uranium (Niger, Mali – dormant projects)

- Manganese, bauxite, lithium (Guinea, Madagascar – still exploratory)

- Tantalite and cobalt (limited involvement in DRC via third parties)

These projects are in early-phase extraction or JV negotiations. Russia’s earnings here are smaller, but growing as sanctions push it deeper into resource diplomacy.

TOTAL ESTIMATED ANNUAL REVENUE:

~$3–4.5 billion USD/year

This estimate:

- Excludes arms-for-resources swaps (non-cash flow),

- Assumes partial reinvestment into local security contracts (Africa Corps/Wagner),

- Reflects both formal and black-market channels.

💰 Where Does the Money Go?

- Offshore accounts (UAE, Cyprus, Türkiye),

- Africa Corps logistics and salaries,

- Russian defense-industrial purchases circumventing sanctions,

- Political bribes and regime maintenance (to ensure access to mines),

📉 Limitations & Risks

- Local instability: coups, unrest can disrupt access.

- Western sanctions expansion: especially if third-party traders in UAE, Turkey face pressure.

- Smuggling loss: up to 30–40% of value may leak due to inefficiencies or local corruption.