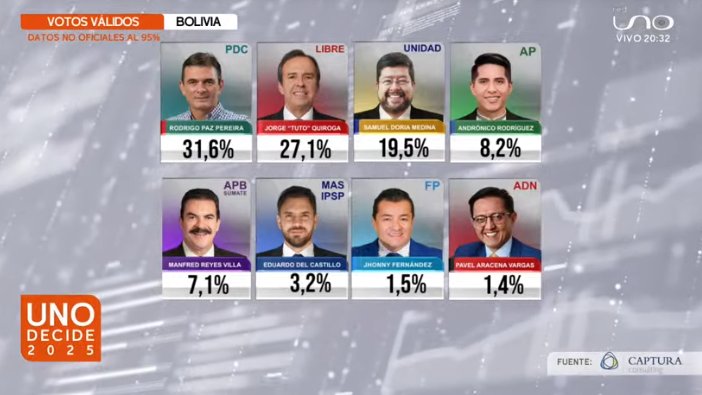

Bolivia heads to its first-ever presidential runoff on October 19, 2025, after an upset first round ended two decades of MAS dominance. The match-up pits centrist senator Rodrigo Paz Pereira (≈32%) against conservative ex-president Jorge “Tuto” Quiroga (≈27%); neither cleared the 40% +10-point rule to win outright. The runoff will determine whether La Paz opts for moderate, coalition-style reform (Paz) or sharper market shock therapy and state retrenchment (Quiroga), amid the country’s worst economic crunch in years

Why it matters

- Historic inflection: The first round shattered the MAS-IPSP era (Evo Morales/Luis Arce), with MAS figures in single digits—an unprecedented collapse.

- Macro stress: Dollar shortages, fuel lines, inflation spikes, and fraying subsidies have turned pocketbook risk into the election’s central axis. Markets rallied on the prospect of policy change after Aug. 17.

- Runoff rules: If no ticket wins 50% (or 40% with a 10-point margin) a second round is mandated—setting up Oct. 19.

Coalitions, Messages, Math

Rodrigo Paz Pereira (Christian Democratic Party)

- Offer: Anti-corruption, pragmatist “inclusive capitalism,” gradual fiscal consolidation; decentralization to ease regional tensions. Running mate Edman Lara (ex-police captain) amplifies law-and-order/clean-government brand.

- Path to 50%: Court urban lower-middle voters disenchanted with MAS (notably El Alto drift), plus centrist endorsements (e.g., business-friendly blocs.

Jorge “Tuto” Quiroga (Libre)

- Offer: Orthodoxy on macro stabilization—spending cuts, external financing, liberalization; “back to rule-of-law and investment climate

- Path to 50%: Consolidate right-of-center vote, pull conservatives in Santa Cruz/lowlands; capitalize on security and anti-corruption fatigue with MAS-era elites

Where MAS goes now

- Residual MAS vote & null/blank protest ballots (pushed by Morales) become kingmakers by abstention or reluctant second-choice migration; turnout elasticity could decide margins

- Crisis management & IMF question.

Paz signals calibration; Quiroga telegraphs faster fiscal correction. Either will inherit subsidy reforms, FX rationing, and debt rollover risk. Markets prefer clarity; streets may not- Lithium strategy

Pivot from state-centric JV model (with Chinese/other consortia) toward de-risked, rules-based frameworks could accelerate capex—or trigger contract fights. (Watch for audits vs. continuity.)- Gas decline & revenue gap

Maturing fields and capex shortfalls constrain the budget; whoever wins needs credible upstream policy to avoid austerity-only optics.- Rule of law & corruption.

Edman Lara’s brand helped Paz; Quiroga’s pitch leans on institutional cleanup. Expect early moves on procurement, customs, and police reform- Social peace & regional balance.

El Alto/Cochabamba sensitivity, Santa Cruz-La Paz fault lines—any fuel or transport shock can reignite protest cycles.

Voter geography (very high level)

- Highlands (La Paz, Oruro, Potosí): Fragmented MAS base; Paz gains from anti-corruption and moderate tone; Quiroga competitive with older anti-MAS vote

- Lowlands (Santa Cruz, Beni, Pando): Business/right-leaning; advantage Quiroga, but Paz can make inroads with governance and predictability pitch.

- El Alto: Symbolic bellwether; any continuation of Paz’s first-round traction here is determinative

Scenarios

- Narrow Paz win with stitched coalition (≈45–55%)—baseline.

Paz collects centrist and parts of anti-MAS vote; promises “stability first” 100-day plan, modest subsidy retargeting, FX normalization, and a lithium investment roadmap. Governs via cross-bench deals.- Quiroga comeback (≈35–45%)—plausible.

Right consolidates; turnout dips among ex-MAS urban poor; mandate for faster fiscal shock. Higher near-term protest risk; better near-term market relief if reforms are sequenced well.

- Contested finish (≈10%).

- Tight margin + logistical hiccups or localized violence produce legal wrangling and short-term instability; reputational hit unless swiftly adjudicated by the TSE/observers.

Risks & tripwires to watch

- Turnout volatility & null/blank rates (Morales line). If nulls spike, legitimacy narratives get louder

- Fuel/FX shocks pre-vote. Any supply crunch moves undecideds and raises protest probability.

- Endorsements & pacts. Where do Samuel Doria Medina-type business blocs and regional leaders land? (Signals coalition governability.)

- Security incidents / disinfo. Fringe mobilizations around the count; watch social media narratives attempting to pre-delegitimize TSE.

- Litigation & international observation. OAS/EU observer readouts will shape acceptance of results.

Implications beyond Bolivia

- Regional political cycle: A runoff between two non-MAS figures reinforces a broader post-pink-tide correctionnarrative across the Andes

- Energy transition footprints: Clearer lithium and gas policies affect global EV supply chains and Southern Cone power markets.

- External alignment: Expect pragmatic hedging: keep ties with China for minerals/infra while warming to Western DFIs if conditionality is manageable.

What a new president must do in 100 days (actionable yardsticks)

- Crisis triage plan: FX and fuels stabilization package; targeted subsidy retuning; transparent import prioritization.

- Rule-of-law signal: Anti-corruption decrees, high-visibility customs/police actions, procurement transparency portal.

- Lithium/gas roadmap: Publish a contract audit calendar + standardized terms; quick wins on permitting and grid bottlenecks.

- Social compact: Indexed transport vouchers or cash-plus measures in hotspot cities to blunt reform pain.

Markets & multilaterals: Open with IMF/CAF/IDB for backstop lines; telegraph a credible fiscal anchor to steady bonds (which already bounced after round one).

More on this story: The situation in Bolivia could turn into a civil war