Divergence in posture: Washington has kept to a zero-yield moratorium since 1992 while expanding subcritical(non-explosive) experiments to steward the stockpile; Moscow de-ratified the CTBT in 2023 and, after new U.S. political signals this week, has ordered proposals on how to resume full-scale explosive testing—framed as contingent on U.S. action.

Russian reasons: parity politics with the U.S.; coercive signaling amid New START’s looming expiration (Feb 5, 2026); technical/political desire to validate or showcase novel systems; domestic narrative management; and pressure on the CTBT regime.

Legal & normative shock: Any return to explosive testing would erode the CTBT norm, stress UNSCR 2310 (2016), and further unravel the arms-control architecture already weakened by New START’s suspension.

Third-party stances: CTBTO, EU, UK, France push restraint; China maintains a moratorium but has visibly expanded Lop Nur; India & Pakistan remain un-ratified holdouts; DPRK signals readiness for a seventh test.

Escalation: Renewed testing risks a cascade—U.S.–Russia tit-for-tat, China responding in kind, and opportunistic tests by DPRK/India/Pakistan—accelerating qualitative arms racing and degrading crisis stability.

1) What each side is saying—and how it differs

UnitedStates.

- Policy: No explosive tests since 1992; relies on the Science-Based Stockpile Stewardship Program and subcritical experiments (no self-sustaining chain reaction). The NNSA publicly emphasizes there is “no technical need” to return to explosive testing.

- 2025 signals: President Trump said the U.S. would restart nuclear testing; the Energy Secretary then clarified that any planned activities would be noncritical (i.e., not nuclear detonations). This mixed message alarmed arms-control bodies and allies.

Russia.

- Legal move: Moscow withdrew its CTBT ratification in Nov 2023, saying it was “mirroring” the U.S. (which signed but never ratified).

- 2025 signals: After the new U.S. remarks, Putin ordered ministries to submit proposals for possible resumptionof full-scale tests; Defense Minister Belousov publicly urged immediate preparations at Novaya Zemlya. The Kremlin then downplayed this as a study, not a “go” order—still a deliberate escalation in rhetoric.

- Context: Russia has been modernizing its Arctic test site; open-source analysis shows maintenance/upgrades consistent with potential readiness.

Bottom line: The U.S. position—despite political noise—remains zero-yield; Russia has moved the Overton windowtoward explosive testing by de-ratifying CTBT and now tasking a test-resumption plan.

2) Why Russia is doing this (primary drivers)

- Parity & leverage

Moscow wants treaty and political symmetry with Washington: de-ratification “to mirror” the U.S. non-ratification; now, conditional readiness to test “if the U.S. does.” This builds bargaining leverage as the post-Cold-War arms-control framework frays. - New START endgame (Feb 2026)

With New START inspections suspended and expiry near, threatening tests increases pressure on Washington and signals costs of no replacement—or sets pretexts for a freer Russian modernization path. - Technical and demonstrative motives

Although both sides can maintain reliability without explosions, Russia may seek data and demonstration for new or modified warheads tied to novel systems (Sarmat/Avangard, Poseidon, Burevestnik) and to validate production post-sanctions. Site modernization supports at least optionality. - Coercive signaling in the Ukraine/NATO theater

Nuclear testing talk raises perceived stakes and aims to deter Western support to Ukraine by normalizing nuclear risk in political discourse. - Domestic narrative & elite cohesion

Saber-rattling sustains the image of strategic parity and can rally domestic elites by reframing Western pressure as a nuclear-age showdown.

3) Consequences for international conventions and treaties

- CTBT (1996)

- Norm erosion: Russia’s de-ratification and “preparations” talk weakens the near-universal testing moratorium and undercuts momentum from the Article XIV Conference (Sept 2025) and civil society mobilization.

- UNSCR 2310 (2016): The Council urged all states—especially Annex-2—to sign/ratify and refrain from tests; renewed testing would clash with that political commitment.

- Verification & IMS: CTBTO underscores its global system can detect explosive tests and warns any such test would harm peace and security.

- NPT regime health

- A U.S.–Russia return to testing would weaken non-proliferation norms, complicate the run-up to the 2026 NPT Review Conference, and embolden threshold states.

- New START

- Testing brinkmanship makes a follow-on or even stop-gap extension harder politically; Moscow has sent mixed signals about any replacement arrangement.

4) Where others stand (selected actors)

- CTBTO/NGOs: Strong, public pushback; call for restraint and CTBT entry into force. Reuters+1

- EU (and most of Europe): Reiterates CTBT entry-into-force as a priority; urges moratorium preservation. UK & France—both post-testing powers—consistently support CTBT and highlight their dismantled test infrastructures.

- China: Maintains a moratorium but has expanded Lop Nur, increasing ambiguity over potential low-yield or readiness activities. Beijing would likely frame any U.S.–Russia move as justification to keep options open.

- India & Pakistan: Neither has signed/ratified; no recent movement toward CTBT even as both cite restraint since 1998—testing by a P5 state could loosen this restraint.

- DPRK: Signals readiness for a seventh test at leader’s decision; renewed great-power testing would provide political cover

5) What this means for escalation

Escalation ladder effects.

- Symbolic to kinetic: Talk of testing shifts the Overton window; an actual explosive test by any P5 could trigger reciprocal tests and a qualitative arms race (new pits, new primaries/secondaries, tailored yields).

- Alliance dynamics: Testing rhetoric complicates NATO/EU cohesion and Indo-Pacific hedging; it pressures allies to signal-match and invest in harder postures.

- Crisis stability: Renewed atmospheric or underground detonations (even at remote sites) would heighten alert postures, shorten decision times, and blur thresholds between testing, exercises, and deployment.

- Regional opportunism: DPRK—and potentially India/Pakistan—could exploit a permissive environment to break their own pauses, with follow-on missile testing cycles.

Policy implications & options (for Western/EU audiences)

- Hold the line on zero-yield: Reaffirm publicly that subcritical work remains within zero-yield norms; avoid ambiguous rhetoric that Moscow can instrumentalize.

- Fortify CTBTO/IMS: Increase funding and political backing; pre-announce forensic transparency packages(rapid public release of detection data if anyone tests).

- Tie testing to costs: Coordinate automatic sanctions triggers and export controls if any explosive test occurs; socialize this within G7/EU/NATO.

- Arms-control triage: Pursue narrow, verifiable guardrails ahead of Feb 2026—e.g., mutual notifications on subcritical experiments; reciprocal site transparency; a no-explosive-tests pledge even absent CTBT entry into force.

- Engage China, India, Pakistan: Quiet diplomacy to disincentivize opportunistic tests; leverage UK–France credibility on moratorium stewardship.

Key facts to cite

- U.S. status: Last explosive test 1992; subcritical work continues; no technical need for explosive testing, per NNSA.

- Russia status: CTBT de-ratification (Nov 2, 2023); Nov 2025—Putin orders proposals for possible resumption; Belousov urges immediate preparations at Novaya Zemlya; Kremlin later frames it as a “study.”

- CTBT regime: 187 signatories, 178 ratifications; Article XIV Conference (Sept 2025) pressed for entry into force; CTBTO warns any explosive test harms peace/security.

- New START: In force to Feb 5, 2026; Russia suspended participation in 2023.

- China: Visible Lop Nur expansion; no declared explosive tests.

- DPRK: Ready for a seventh test on leadership decision; last test in 2017.

Russia’s Nuclear Testing Narrative vs. the United States: Strategic Motives, Treaty Erosion, and Escalation Pathways

Moscow’s renewed signaling about resuming full-scale nuclear explosive testing marks one of the most consequential shifts in Russia’s strategic messaging since its suspension of New START participation. Unlike the United States—whose recent statements reflect political turbulence but no operational preparations—Russia’s rhetoric is deliberate, structured, and embedded in a broader campaign to erode arms-control norms, pressure the West ahead of crucial 2026 decision points, and expand room for coercive escalation.

Russia’s aim is not simply technical validation of its nuclear arsenal. It is pursuing an information-psychological strategy designed to normalize the idea of nuclear brinkmanship, undermine the Comprehensive Nuclear-Test-Ban Treaty (CTBT), and shape global perceptions of U.S. weakness and fragmentation. The result is a growing risk that the post–Cold War arms-control order will collapse entirely, opening an unregulated era of nuclear competition involving not only Russia and the United States but also China, North Korea, and potentially India and Pakistan.

1. Background: Two Diverging Trajectories

1.1 United States: Mixed Rhetoric, Stable Posture

Since 1992, the United States has upheld a zero-yield moratorium on explosive nuclear testing. Recent political statements from U.S. leadership about the possibility of “resuming testing” were largely rhetorical signaling rather than policy direction.

The U.S. maintains robust subcritical testing and simulation programs, which fully sustain the warhead stockpile without breaking the global moratorium. No preparations, funding, or site restoration consistent with a return to large-scale testing have been initiated.

1.2 Russia: Legal Preparedness and Strategic Messaging

Russia de-ratified the CTBT in 2023, a move justified as “mirroring the U.S.” but clearly intended to remove legal and political constraints on explosive testing.

Since late 2024 and intensifying in 2025, Russian officials:

- Ordered the government and Defense Ministry to submit proposals for resuming tests.

- Publicly emphasized readiness of Novaya Zemlya, including infrastructure modernization.

- Reframed testing as a contingent but legitimate option, not a taboo.

The Kremlin uses ambiguity—to threaten testing without fully committing—and to keep the West guessing.

. Why Russia is Signaling Nuclear Testing Now

2.1 Strategic Parity and Leverage Ahead of 2026

The New START Treaty expires in February 2026. Moscow sees testing as a pressure lever:

- To coerce Washington into a less restrictive post-New START framework.

- To regain psychological parity with the U.S., which maintains unchallengeable advantages in simulations and stockpile science.

- To force the West into negotiations on Russian terms.

Testing is thus part of a broader coercive bargaining posture.

2.2 Validating New “Exotic” Systems

Russia’s new-generation nuclear delivery systems—Poseidon, Burevestnik, Sarmat, and modified Avangard payloads—have structural risks that cannot be fully modeled without experimental data.

Moscow’s military-industrial complex, degraded by sanctions, faces quality-control uncertainties. Testing provides:

- A technical crutch to compensate for manufacturing variances;

- Political justification for further defense allocations;

- Demonstrative signaling toward adversaries and domestic elites.

2.3 Coercive Influence on NATO’s Ukraine Policy

By raising nuclear stakes, Moscow seeks to:

- Weaken European resolve;

- Create a perception of acceptable nuclear risk

- Intimidate NATO members debating deeper involvement in Ukraine

Testing rhetoric is a psychological weapon to shape Western decision-making.

2.4 Domestic Narrative Engineering

Nuclear mythology remains central to Russian elite cohesion. Testing threats:

- Reinforce Putin’s legitimacy as the guardian of national survival;

- Rally hardliners during internal political transitions;

- Frame Russia as a superpower equal to the United States, despite economic decline.

2.5 Undermining International Norms as Strategy

Russia recognizes that world governance frameworks constrain U.S. power more than its own. By eroding the CTBT norm, Moscow:

- Damages the credibility of Western-led treaty regimes;

- Positions itself as the disruptor of “Western hegemony”;

- Creates a permissive environment for other nuclear aspirants;

3. Consequences for International Conventions and Treaties.

3.1 CTBT: From Dormant to Damaged

The CTBT has never entered into force, but its normative power has been significant. Russia’s de-ratification—and now, open talk of explosive testing—deals the CTBT its most serious blow in decades.

Key impacts:

- Normative weakening: Global restraint fractures once a P5 state resumes testing.

- Verification politicization: The CTBTO International Monitoring System becomes a political battlefield.

- Precedent for regional actors: India, Pakistan, and North Korea gain justification to pursue their own testing agendas.

3.2 NPT Stress and the 2026 Review Crisis

A Russian test would undermine the Non-Proliferation Treaty at a moment of maximum fragility:

- Non-nuclear states would accuse nuclear-weapon states of violating Article VI (disarmament commitments).

- The likelihood of a failed 2026 NPT Review Conference rises sharply.

- Threshold states—Saudi Arabia, Iran, South Korea—would see nuclear ambitions legitimized.

3.3 New START: Strategic Collapse

Testing talk further reduces prospects for:

- A New START extension

- A successor treaty

- Any future transparency regime

Without arms-control anchors, strategic stability deteriorates into unregulated competition.

Global Reactions: Who Stands Where

4.1 China

Beijing maintains a moratorium but has visibly expanded its Lop Nur testing infrastructure. China’s position is opportunistic:

- Publicly: calls for restraint and CTBT entry into force

- Privately: benefits from the erosion of U.S.–Russia constraints

- Operationally: prepares for potential low-yield or calibration tests

If Russia tests first, China will feel politically insulated to follow.

4.2 Europeans (EU, UK, France)

Europe uniformly opposes renewed testing:

- UK & France: maintain moratoria but have dismantled major test infrastructure

- EU: fears a return to Cold War instability

- NATO: forced to contemplate matching Russian doctrinal shifts

European diplomats privately admit that another Russian test could kill the CTBT permanently.

4.3 India and Pakistan

Both see Russia as precedent-setter:

- India: may consider renewed tests to qualify its thermonuclear devices

- Pakistan: would counter with its own, worsening South Asian instability

4.4 North Korea

DPRK benefits the most:

- Any P5 test provides political cover for Test #7

- Pyongyang can portray its actions as part of “great-power normalization”

- It accelerates missile-nuclear integration

4.5 Global South

Many view Russian testing threats as:

- A symbol of Western treaty failure

- Evidence that the nuclear order favors the strong

- A reason to seek security outside U.S.-dominated frameworks

This is strategically advantageous for Russia.

. Escalation Pathways: How Testing Changes the Strategic Environment

Russia’s rhetoric does not exist in isolation—it fits into an escalation ladder designed to increase risk tolerance and reduce Western confidence.

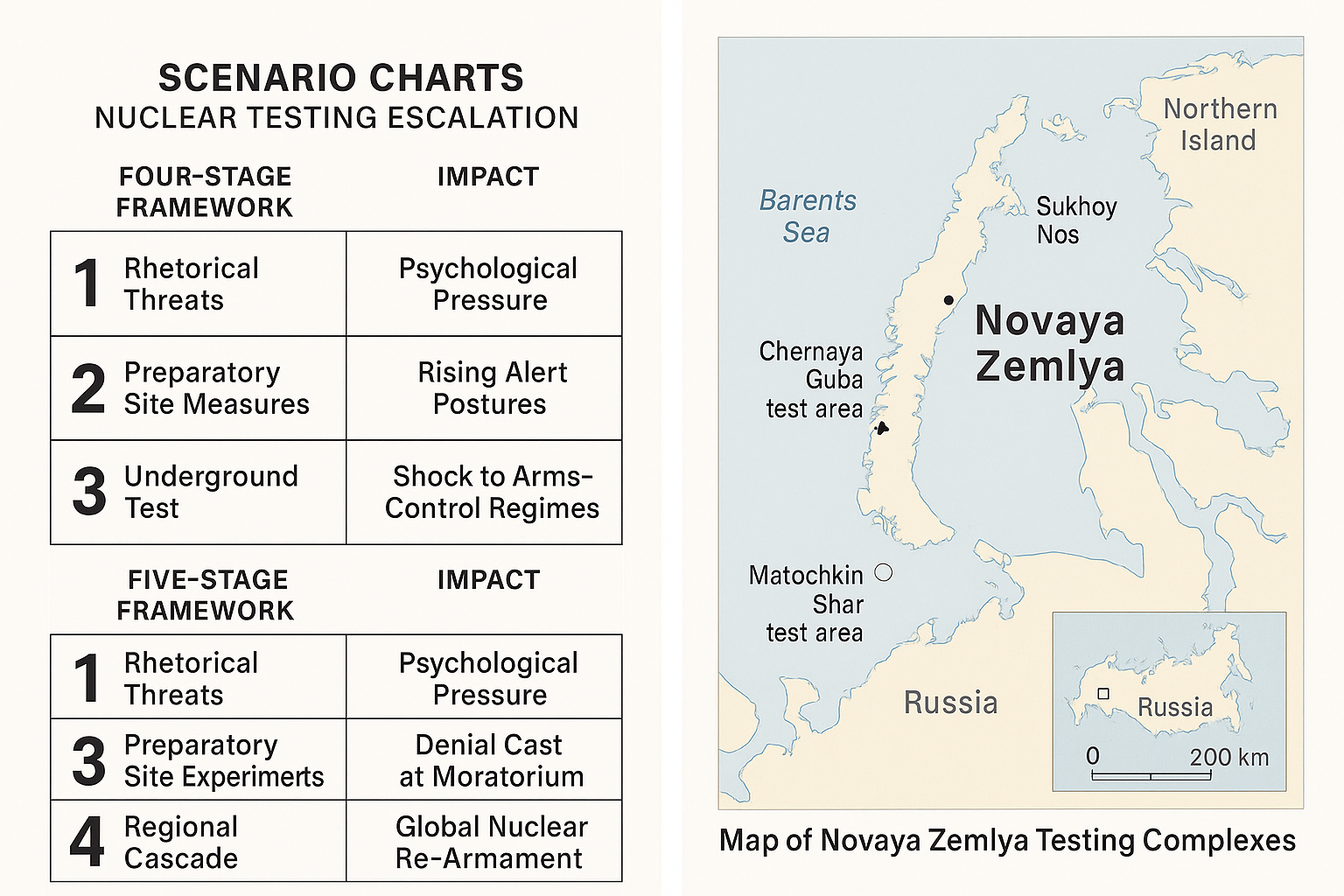

Below is an intelligence-style escalation matrix.

Escalation Matrix: Nuclear Testing Pathways (2025–2027)

| Stage | Russian Action | Western Perception | Impact |

| 1: Rhetorical Threats | Repeated references to “readiness” to test | Psychological pressure | Increased NATO caution |

| 2: Site Activity | Movement at Novaya Zemlya, runway or shaft preparations | Ambiguous | Raises alert levels; fuels intelligence competition |

| 3: Subcritical Ambiguity | Russia conducts “opaque” low-yield experiments | Doubts about Russian compliance | Undermines CTBT monitoring |

| 4: Full Underground Test | Seismic detection confirms detonation | Strategic shock | End of CTBT; global nuclear chain reaction |

| 5: Regional Cascade | China, India, Pakistan, DPRK follow | Multipolar testing | New qualitative arms race |

What It Means for Global Security

6.1 Increased Crisis Instability

Testing signals that nuclear thresholds are becoming politically acceptable. This shortens decision cycles and weakens confidence in deterrence stability.

6.2 Race Toward New Warhead Types

Testing accelerates:

- Low-yield warheads

- Earth-penetrating designs

- Tailored-yield battlefield nuclear options

Russia would exploit this to pressure NATO’s eastern front.

6.3 Darkening the Strategic Environment

A renewed testing era means:

- No trust in verification regimes

- No transparency on warhead counts

- Minimal predictability in crises

- Higher chance of miscalculation

7. Policy Recommendations for Western Governments

7.1 Reassert Zero-Yield Discipline

The U.S. and allies should publicly reaffirm adherence to zero-yield—even while preparing contingency responses.

7.2 Signal Cost Imposition

Define consequences if Moscow crosses the testing threshold:

- Coordinated G7 sanctions packages

- Denial of dual-use technologies to Russia’s nuclear laboratories

- Exclusion of Russia from civilian nuclear markets

7.3 Expand CTBTO Mandate

Strengthen:

- On-site inspection readiness

- Data transparency protocols

- Real-time seismic communication channels

7.4 Accelerate U.S. and NATO Deterrence Modernization

Quietly increase:

- Production of modern warheads

- Deployment of dual-capable aircraft

- Missile-defense coverage in Europe

7.5 Engage China, India, and Pakistan Early

Diplomacy must aim to prevent a regional domino scenario.

Russia’s nuclear testing rhetoric is not an isolated policy signal. It forms part of a broader strategy to undermine Western-led treaty architectures, normalize nuclear coercion, and expand Russia’s strategic maneuvering spaceahead of the post–New START era. While the United States remains committed—operationally if not always rhetorically—to the global testing moratorium, Moscow’s approach is calculated, asymmetric, and deliberately destabilizing.If Russia proceeds with an explosive test, it will shatter the remaining pillars of the post–Cold War arms-control regime and open a new era ofunregulated nuclear competition. The strategic environment would grow significantly more dangerous—not only for NATO but for the entire international system.

More on this story: Poseidon and the Politics of Fear: Russia’s New Deterrence Doctrine”

More on this story: Undoing the Agreement: How Iran and Russia Are Redefining the Nuclear Order

More on this story: Russia’s Nuclear Blackmail as a Tool to Pressure the West

More on this story: Failed Satan II Missile Test Heightens Concerns About Russia’s Nuclear Arsenal

More on this story: Kremlin Continues to Intimidate the West with Nuclear War Threats

More on this story: Russia looking for reason to launch nuclear testing and total mobilization

More on this story: Russia’s nuclear arsenal seems grossly exaggerated

More on this story: Russia’s nuclear threats: risks and responsive options

More on this story: Risk indicators for tactical nuclear assault by Russia on targets in Europe