Guinea-Bissau heads to simultaneous presidential and legislative elections on 23 November 2025 (with a possible second presidential round on 30 November) under highly contentious conditions: the opposition’s main force (PAIGC/Pai Terra Ranka) has been barred by court rulings, and President Umaro Sissoco Embaló has consolidated control after dissolving parliament in Dec 2023, expelling/pressuring ECOWAS mediators in early 2025, and reshuffling the premiership months before the vote. The risk picture features institutional capture, security force politicking, and the country’s persistent narco-economy. External stakes are rising: Russia is courting Bissau with mining/port deals, while ECOWAS and the EU fret about democratic backsliding and post-election stability.

Key actors

- Umaro Sissoco Embaló (incumbent president) – Seeks a second term amid a mandate dispute; dissolved the opposition-led parliament in 2023; escalated against ECOWAS earlier in 2025; announced November elections after travel to Moscow/Baku/Budapest

- Braima Camará (Prime Minister, MADEM-G15) – Appointed August 2025 to organize elections; a longtime power broker whose selection signals presidential control over the electoral machinery

- PAIGC / “Pai Terra Ranka” (Domingos Simões Pereira) – Historic independence party and principal opposition bloc disqualified by the Supreme Court over filing/registration issues; Pereira himself excluded from the provisional presidential list

- Other parties – PRS, APU-PDGB and smaller lists will contest but lack PAIGC’s national machine, helping the presidency in a fragmented field. (Context drawn from election listings and prior seat shares

- Security elites – Factionalized military and security services retain outsized veto power given repeated coup/putsch episodes and are pivotal in a disputed-result scenario

- ECOWAS/UNOWAS – Tried to mediate mandate/election timing; mission withdrew after threats of expulsion; leverage diminished going into the vote.

Structural trends shaping the vote

- Judicialized exclusion and institutional asymmetry – Court decisions sidelining PAIGC/Pai Terra Ranka and Pereira set the stage for low-competition elections and post-vote legitimacy disputes

- Executive dominance after parliamentary dissolution – Repeated dissolutions (2022, 2023) normalized emergency politics and weakened legislative oversight

- Mediator fatigue & regional isolation – ECOWAS withdrawal signals shrinking guardrails; Bissau’s latitude to manage results domestically has grown

- Criminal-economy resilience – The “narco-corridor” remains a background risk amplifier (money, coercion, and rogue networks), complicating any clean security environment around polling

- Great-power courtship – Russia advances extractives/port interests; China/others keep a watching brief; Portugal/EU scrutinize rights and media pressure.

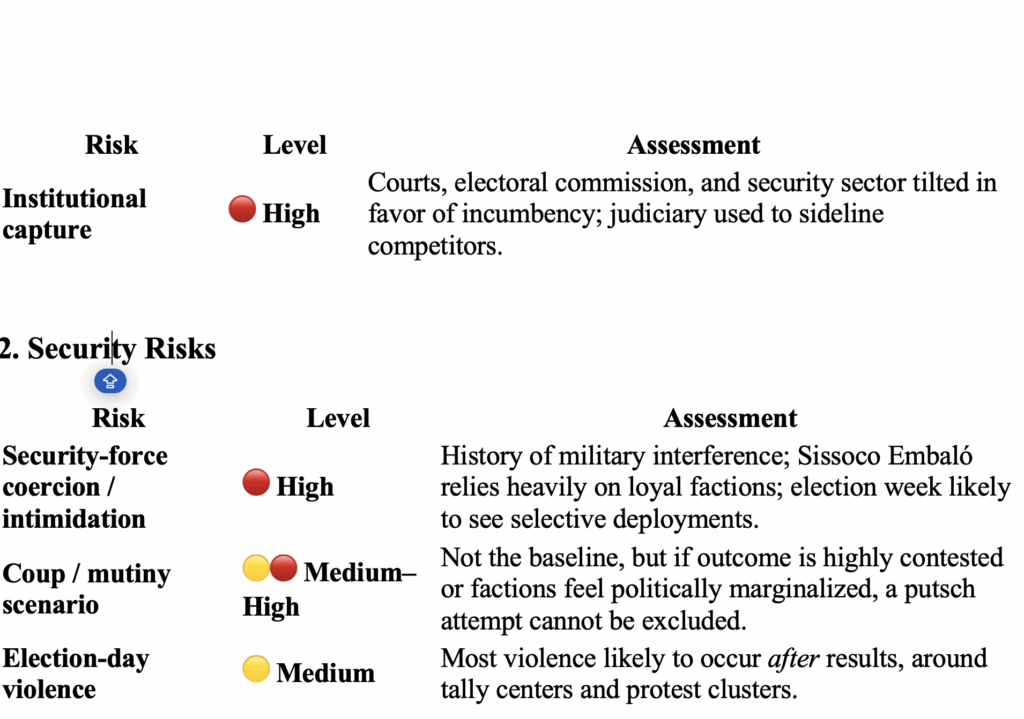

Risk map (election period)

- Operational risks: voter roll disputes; late court decisions; local intimidation; logistics and security constraints outside Bissau

- Political risks: boycott calls; mass protests around certification; selective enforcement against opposition figures; information operations

- Security risks: arrest waves, “coup-plot” narratives, and selective deployments that chill turnout; potential clashes near key tally centers

- External risks: ECOWAS censure limited by earlier standoffs; bilateral pressure from Portugal/EU; opportunistic Russian economic-security signaling

Scenarios (0–3 months)

1) Managed continuity (most likely; medium impact)

Incumbent advantage plus opposition fragmentation delivers Embaló re-election and a legislature friendly to the presidency. International partners issue concerned but cautious statements; ECOWAS avoids direct confrontation. Expect incremental cabinet reshuffles and a push to normalize the legal path that barred PAIGC, with limited urban protests. Risks: legitimacy deficit; later instability if economic/donor conditions worsen

2) Disputed outcome with coercive stabilization (plausible; high impact)

Tight or regionally uneven results prompt opposition mobilization. Government highlights “security threats” and arrests select figures; security forces disperse crowds; certification proceeds under pressure. ECOWAS hedges; Brussels and Lisbon warn on aid conditionality. Risks: episodic violence; donor freezes; reputational hit.

3) Shock opposition performance via allied lists (lower probability; very high impact)

Despite PAIGC’s exclusion, anti-incumbent votes coalesce behind secondary tickets/independents, producing an awkward cohabitation or legislative check. Expect intense litigation, bargaining, and possible elite splits in the security services. Risks: paralysis; snap votes; temptation for extra-legal fixes

4) Extra-constitutional rupture (tail risk; extreme impact)

A failed putsch or a major mutiny around certification triggers state of exception and prolonged ECOWAS crisis diplomacy. Foreign commercial partners (ports/mining) pause or renegotiate exposure; humanitarian indicators worsen

Foreign influence & external stakes

- Russia – February 2025 resource/port understandings. (bauxite/phosphate/hydrocarbons; Buba deep-water port concept; Rusal interest). Even absent formal security footprints, Moscow gains leverage over elite financing and post-election concessions (licenses, logistics corridors). If continuity prevails, expect deal operationalization and political cover for it

- ECOWAS/UNOWAS – Capacity to compel corrective steps is diminished after the March withdrawal; any censure will likely be rhetorical unless instability spills regionally

- EU/Portugal – Focused on media expulsions, rule-of-law concerns, and election integrity; can condition budgetary support and visas but reluctant to isolate Bissau fully.

- China/other investors – Watching mining/logistics; risk-reward calculus improves with political continuity. Quiet diplomacy likely on infrastructure and fisheries. (Context from broader Guinea/region investment patterns.

- Transnational crime networks – Seek permissive governance regardless of winner; instability windows are exploited for cocaine transshipment and money flows.

What to watch (indicators)

- Final candidate list changes or late rehabilitations via courts/CEC

- Security force rotations around Bissau and ports in the week before polls

- ECOWAS language post-vote: “concern” vs. “non-recognition” signals

- Russian commercial steps (MoUs crystallizing into contracts; delegations tied to Rusal/ports

- Media/NGO constraints (expulsions, credentialing limits

Consequences (6–12 months outlook)

- If continuity (Scen. 1):

- Governance: Consolidation of a presidentialized system; constrained checks and balances.

- Economy: Resource deals progress; port/mining logistics advance; donor relations uneasy but functional.

- Security/Crime: Narco-corridor persists; episodic crackdowns calibrated to external pressure

- If disputed (Scen. 2):

- Governance: Legal warfare; ad-hoc states of exception.

- External: ECOWAS/EU conditionality; risk of sanctions on individuals; financing delays.

- Market: Investors price in delay risk for port/mining; cash-flow stress in ministries

- If opposition breakthrough (Scen. 3):

- Governance: Hard bargaining to reopen political space; possible partial PAIGC reintegration via by-elections or pacts.

- External: Warmer EU ties; stricter oversight on resource deals; higher friction with Moscow if contracts are reviewed.

- If rupture (Scen. 4):

- Governance: Prolonged stalemate; potential ECOWAS sanctions/deployment debate.

- External: Aid suspension; capital flight; elevated migration and illicit flows in the sub-region

analytic judgment

The baseline is a managed-continuity outcome favoring Embaló, enabled by judicial exclusions and institutional control. The principal danger is not election-day violence per se but post-certification legitimacy deficits that entrench executive dominance and invite external deal-making—notably with Russia in extractives/ports—while ECOWAS leverage remains weak. Any surprise opposition surge would produce high-stakes litigation and elite maneuvering, with outcomes hinging on the stance of the security services and the calculus of foreign partners whose investments can be weaponized as political leverage.

Traffic-Light Risk Matrix (Guinea-Bissau Elections — Nov 2025)Red = High risk | Yellow = Medium | Green = Low

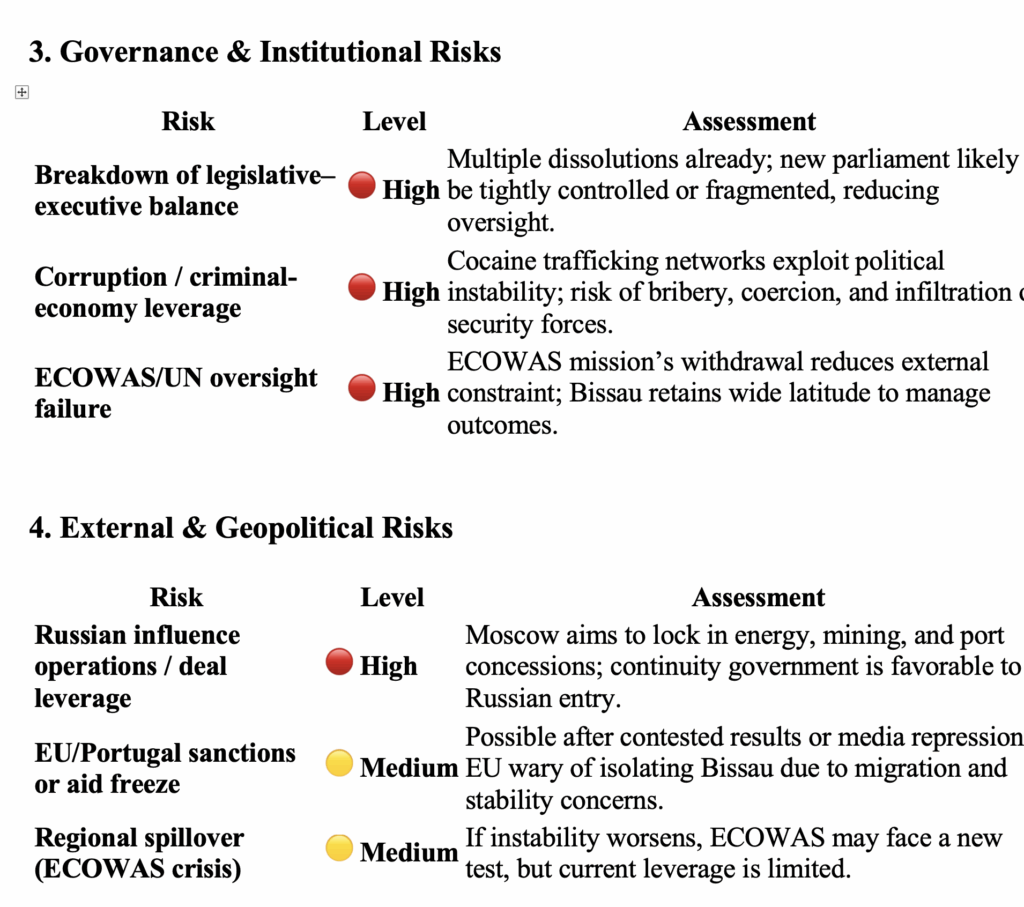

Stakeholder Map (Guinea-Bissau: Elections 2025)

1. Internal Actors

A) Presidency (Umaro Sissoco Embaló)

- Interests: Consolidate second term; maintain dominance through judiciary and security forces; control resource and port deals.

- Capabilities: Loyal security factions, judicial influence, diplomatic ties with Russia and Azerbaijan.

- Risks: Legitimacy deficits; potential post-election protests; EU and ECOWAS pushback.

B) Government & MADEM-G15 (Braima Camará, PM)

- Interests: Organize elections under presidency’s control; secure parliamentary majority.

- Capabilities: Access to state resources; influence over electoral administration.

- Risks: Accountability for unfair processes; reputational costs abroad.

C) Opposition (PAIGC/Pai Terra Ranka; Domingos Simões Pereira)

- Interests: Re-entry into political arena; capitalize on popular dissatisfaction; challenge exclusion.

- Capabilities: Historical legitimacy; strong grassroots support; diaspora backing.

- Risks: Legal exclusion, arrest waves, limited media access.

D) Military & Security Services

- Interests: Maintain influence; secure financial channels; avoid rapid political change.

- Capabilities: History of coups; decisive in crisis moments.

- Risks: Factional splits; external scrutiny; criminal-network penetration.

E) Criminal Networks (Narco-corridor actors)

- Interests: Preserve permissive environment for cocaine transit; maintain ties with political brokers.

- Capabilities: Money, weapons, corrupt enablers inside security forces.

- Risks: Crackdowns if EU or U.S. exert pressure on new government.

2. External Actors

A) Russia

- Interests: Gain strategic foothold via mining, hydrocarbons, and Buba port; expand influence in West Africa after setbacks in Mali/Niger spheres.

- Capabilities: Investment promises, political cover, covert influence.

- Risks: Contract revision if opposition gains ground; backlash from EU.

B) ECOWAS

- Interests: Regional stability; prevent coups; uphold minimum democratic standards.

- Capabilities: Diplomatic pressure; sanctions; mediation.

- Risks: Low leverage after March 2025 withdrawal; internal ECOWAS divisions.

C) EU and Portugal

- Interests: Stability, governance reforms, migration control, anti-crime cooperation.

- Capabilities: Aid, sanctions, visas, diplomatic pressure.

- Risks: Over-pressure may push Bissau toward Russia or China.

D) China

- Interests: Infrastructure, fisheries, long-term resource access.

- Capabilities: Large financing and construction capacity.

- Risks: Political volatility; contract termination in contested outcome.

E) United States

- Interests: Counter narcotics; monitor Russian/Chinese influence; maintain ECOWAS stability.

- Capabilities: Security assistance; diplomatic weight.

- Risks: Limited priority; reactive rather than proactive engagement.

Summary Judgment

Guinea-Bissau’s 2025 elections occur in a high-risk political environment marked by institutional asymmetry, security-force politicking, and foreign actors competing for strategic access.

The traffic-light indicators show multiple red sectors — especially around legitimacy, coercive stabilization, and external influence.

External stakeholders will treat the elections less as a democratic exercise and more as a negotiation over who controls access to ports, minerals, and security relationships in one of West Africa’s most geopolitically exposed microstates.

More on this story: Guinea-Bissau’s foiled coup: linked to drug or against French-friendly President